Advanced: CVP analysis and uncertainty (a) The accountant of Laburnum Ltd is preparing documents for a forthcoming

Question:

Advanced: CVP analysis and uncertainty

(a) The accountant of Laburnum Ltd is preparing documents for a forthcoming meeting of the budget committee. Currently, variable cost is 40% of selling price and total fixed costs are £40 000 per year.

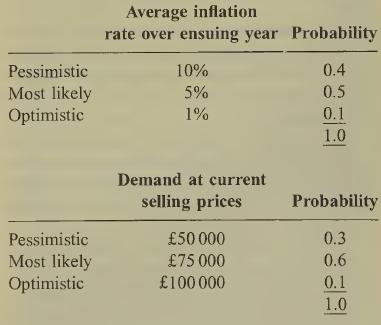

The company uses an historical cost accounting system. There is concern that the level of costs may rise during the ensuing year and the chairman of the budget committee has expressed interest in a probabilistic approach to an investigation of the effect that this will have on historic cost profits. The accountant is attempting to prepare the documents in a way which will be most helpful to the committee members. He has obtained the following esti-

mates from his colleagues:

The demand figures are given in terms of sales value at the current level of selling prices but it is considered that the company could adjust its selling prices in line with the inflation rate without affecting customer demand in real terms.

Some of the company’s fixed costs are contractually fixed and some are apportion¬ ments of past costs; of the total fixed costs, an estimated 85% will remain constant irrespec¬ tive of the inflation rate.

You are required to analyse the foregoing information in a way which you consider will assist management with its budgeting problem. Although you should assume that the directors of Laburnum Ltd are solely interested in the effect of inflation on historic cost profits, you should comment on the validity of the accountant’s intended approach. As part of your analysis you are required to calculate:

(i) the probability of at least breaking even, and (ii) the probability of achieving a profit of at least £20 000. (16 marks)

(b)It can be argued that the use of point estimate probabilities (as above) is too unrealistic because it constrains the demand and cost variables to relatively few values. Briefly describe an alternative simulation approach which might meet this objection. (6 marks)

(Total 22 marks) ACCA Level 2 Management Accounting

Step by Step Answer: