Advanced: Expected NPV calculation and taxes on cashflows Blackwater pic, a manufacturer of speciality chemicals, has been

Question:

Advanced: Expected NPV calculation and taxes on cashflows Blackwater pic, a manufacturer of speciality chemicals, has been reported to the anti-pollution authorities on several occasions in recent years, and fined substantial amounts for making excessive toxic discharges into local rivers. Both the envir¬ onmental lobby and Blackwaters shareholders demand that it clean up its operations.

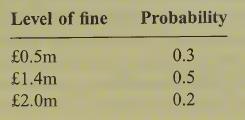

It is estimated that the total fines it may incur over the next four years can be summarised by the following probability distribution (all figures are expressed in present values):

Filta & Strayne Ltd (FSL), a firm of environmental consultants, has advised that new equipment cost-

ing £lm can be installed to virtually eliminate illegal discharges. Unlike fines, expenditure on pollution control equipment is tax-allowable via a 25% writing-down allowance (reducing balance). The rate of corporate tax is 33%, paid with a one- year delay. The equipment will have no resale value after its expected four-year working life, but can be in full working order immediately prior to Black- water’s next financial year.

A European Union Common Pollution Policy grant of 25% of gross expenditure is available, but with payment delayed by a year. Immediately on receipt of the grant from the EU, Blackwater will pay 20% of the grant to FSL as commission. These transactions have no tax implications for Black¬ water.

A disadvantage of the new equipment is that it will raise production costs by £30 per tonne over its operating life. Current production is 10000 tonnes per annum, but is expected to grow by 5% per annum compound. It can be assumed that other production costs and product price are constant over the next four years. No change in working capital is envisaged.

Blackwater applies a discount rate of 12% after all taxes to investment projects of this nature. All cash inflows and outflows occur at year ends.

Required:

(a) Calculate the expected net present value of the investment assuming a four-year operating period.

Briefly comment on your results. (12 marks)

(b) Write a memorandum to Blackwater’s management as to the desirability of the project, taking into account both financial and non-financial criteria.

Step by Step Answer: