Advanced : Impact of taxati on on NPV calculation and lease versus buy decision Turnbull pic is

Question:

Advanced : Impact of taxati on on NPV calculation and lease versus buy decision Turnbull pic is considering the possibility of manufactunng its own requirements for material Kay rather than continuing its present policy of purchasing from an external supplier.

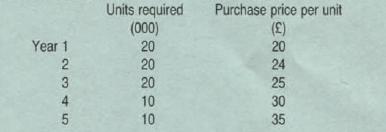

Material Kay is purchased and paid for only at the end of each year and will be reqUired for the next 5 years . Estimates of the demand and the purchase pnce per unit for Kay are:

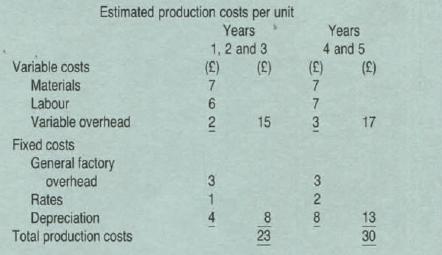

Estimates of the unit costs of producting Kay are:

'General factory overhead is an apport1onment of Turnbull's total factory overheads. ·Rates relate to rates paid on the additional land reqwed (see (ii) below). ·Depreciahon' relates only to the new mach1nery specifically purchased for the production of Kay (see (v)

below).

The following further information is available:

(i) All incremental cash production costs will be paid at the end of the year to which they relate.

(ii) Turnbull would not need to acqwe additional factory space for the production of Kays at it has sufficient for this purpose. This factory space has no alternative use or rental value. However. storage of the bulky raw materials used to produce Kay will necessitate the purchase of a plot of .

adjacent land. The land will cost £120000 and m year 5 w1ll have a resale value of at least £160 000. No tax allowances are available for investmentrn the land and it is fell that there will be no tax consequences arising from its sale.

(i ii) If the proposal goes ahead then it will require the use of a piece of existing equipment. The existing equipment has a book value of £140000 and, if not used in the production of Kay, would be sold now for its market value of £80000.

Estimated salvage value at year S1s £10000. The equrpment has already been subject to 100% tax allowances and any sales value will be subject to assessment to tax . DepreciatiOn of this equipment has been excluded from the cost of production specified above.

(iv) The project will save £40 000 per year in the fixed costs of material handling. This saving has been reflected in the figure of total factory overheads which has been apportioned among all cost centres as general factory overhead.

(v) The new machinery required for the production of Kays has a cost of £400000. This machinery is expected to have no salvage value in year 5. Purchase of the machinery entitles the owner to claim 100% first year capital allowances for tax purposes. There is the possibility of entering into a non-cancellable finance lease to obtain the use of this machinery. Such a lease would require an initial payment of £60 000 at the start of the lease followed by four payments of £1 00 000 made at strictly yearly intervals. Such payments are tax deductible expenses. The alternative to leasing is to finance the purchase of the machinery by borrowing at a pre-tax interest rate of 10% per annum, the current competitive market interest rate for debt.

Turnbull is a profitable company and is able to utilize in full all tax allowances at the earliest opportunity. The tax rate is 50% and the tax delay is 1 year. If the project is accepted it will commence at the end of a tax year and the initial payments, and any lease rentals, will be included in that tax year.

It is Turnbull's policy that investment and financing decisions are appraised separately. All capital projects must be appraised by the financial controller to ascertain whether the project would be worthwhile if purchased. The normal DCF appraisal rate applied to after tax cash flows is 15%. If a project is found to be acceptable, then the treasurer is required to recommend the best method of financing the project and to indicate the desirability of any leasing possibilities. To speed up the analysis of this project the details have been sent to the financial controller and the treasurer at the same time rather than sequentially.

Required:

(a) Carry out the financial controller's analysis and determine whether the project is worthwhile if purchase is the only financing option for the new machinery. (1 0 marks)

(b) Carry out the treasurer's analysis to determine whether purchase or leasing, on the terms specified, would be the best alternative for the new machinery. (5 marks)

(c) Using the same discount rates utilized in

(b) above, indicate the relative merits of lease and purchase if Turnbull would produce tax losses until year 2. Year 2 would produce taxable profits after considering all accumulated losses and thereafter Turnbull will continue to produce taxable profits.

Payment of tax would, when appropriate, be subject to a one year delay. (3 marks)

(d) (i) Comment on the merits and dangers of Turnbull's policy concerning the appraisal of investment and financing decisions. Indicate any improvements which could be recommended.

(ii) Discuss the validity of using the same discount rates for the circumstances of both

(b) and

(c) above. Explain, without calculation, how the lease versus buy decision should be correctly appraised when a firm is in a temporary non-tax-paying position.

Step by Step Answer: