Advanced: Interdivisional profit statements and impact of an investment on interdivisional transfers and profits. The DE Company

Question:

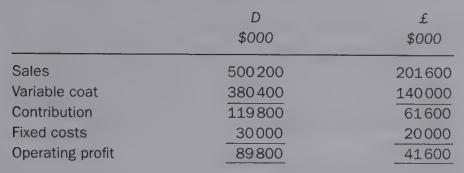

Advanced: Interdivisional profit statements and impact of an investment on interdivisional transfers and profits. The DE Company has two divisions. The following statement shows the performance of each division for the year ended 30 April:

Division E manufactures just one type of component. It sells the components to external customers and also to Division D. During the year to 30 April, Division E operated at its full capacity of 140000 units. The transfer of 70000 units to Division D satisfied that division's total demand for that type of component.

However the external demand was not satisfied. A further 42000 components could have been sold to external customers by Division E at the current price of $1550.

The current policy of the DE Company is that internal sales should be transferred at their opportunity cost. Consequently during (he year, some components were transferred to Division D at the market price and some were transferred at variable cost.

Required:

(a) Prepare an analysis of the sales made by Division E that shows clearly, in units and in $, the internal and external sales made during the year. (3 marks)

(b) Discuss the effect of possible changes in external demand on the profits of Division E, assuming the current transfer pricing policy continues. (6 marks)

Division E is considering investing in new equipment which would reduce its unit variable costs by 20 per cent and increase its capacity by 10 per cent for each of the next five years. The capital cost of the investment is $120m and the equipment would have no value after five years. The DE company and its divisional managers evaluate investments using net present value (NPV) with an 8 per cent cost of capital.

External annual demand for the next five years will continue to be 112000 components at $1550 each but the DE Company will insist that the internal annual demand for 70000 components must be satisfied.

Required:

(c) Assuming that the current transfer pricing policy continues:

(i) Evaluate the investment from the perspective of the manager of Division E. (6 marks)

(ji) Evaluate the investment from the perspective of the DE Company. (4 marks)

(d) Explain TWO factors that should be considered when designing divisional performance measures. (6 marks)

Step by Step Answer: