Advanced: Limiting factors and calculation of optimum selling price using differential calculus (a) Nantderyn Products has two

Question:

Advanced: Limiting factors and calculation of optimum selling price using differential calculus

(a) Nantderyn Products has two main products, Exco and Wyeco, which have unit costs of £12 and £24 respectively.

The company uses a markup of 33V3% in establishing ~s selling prices and the current prices are thus £16 and £32.

With these prices, in the year which is just ending, the company expects to make a profit of £300 000 from having produced and sold 15 000 un~s of Ex co and 30 000 units of Wyeco. This programme will have used all the available processing time in the finishing department. Each unit of Exco requires an hour of processing time in this department and every unit of Wyeco correspondingly requires half an hour.

Rxed overhead was £360000 for the year and this has been charged to the products on the bas1s of the total processing hours used. All other costs may be assumed variable in relation to processing hours. In the current year it is estimated that £60 000 of the fixed overhead will be absorbed by Exco and £300000 by Wyeco With the existing selling prices it is considered that the potential annual demand for Ex co is 20 000 units and that for Wyeco, 40 000 units.

You are required to comment critically on the product mix adopted by Nantderyn Products. Calculate what would have been the optimal plan given that there was no intention of changing the selling prices. (8 marks)

(b) For the forthcoming year increased capaetty has been installed in the fimshing department so that this will no longer be a constraint for any feasible sales programme.

Annual fixed overhead will be increased to £400000 as a consequence of this expansion of facilities. but variable costs per unit are unchanged.

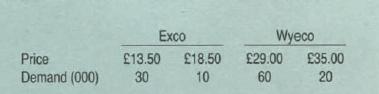

A study commissioned by the Sales Director estimates lhe effect that alterations to the selling prices would have on the sales that could be achieved. The following table has been prepared.

It is thought reasonable to assume that the price/demand relationship is linear. Assuming that the company IS now willing to abandon its cost plus pricing practices, if these can be shown to be deficient, you are required to calculate the optimal selling price for each product and the optimal output levels for these prices. State clearly any assumptions that you find it necessary to make. (8 marks)

(c) The paradox is that, while cost plus pricing is devoid of any theoretical justification, it is widely used in practice.·

Discuss possible justifications for this use

Step by Step Answer: