Advanced: NPV calculation and an evaluation of a lease versus borrowing decision AS ltd is considering using

Question:

Advanced: NPV calculation and an evaluation of a lease versus borrowing decision AS ltd is considering using a machine made by BC Ltd. The machine would cost £60 000 and at the end of a four-year life is expected to have a resale value of £4000, the money to be received in year 5. It would save £29 000 per year over the method that AS ltd currently uses. AS Ltd expects to earn a DCF return of 20% before tax on this type of investment.

AS Ltd is currently earning good profits, but does not expect to have £60 000 available to spend on this machine over the next few years. It is subject to corporation tax at 35% and receives capital allowances of 25% on a reducing balance basis.

You are required to

(a) recommend whether, from an economic viewpoint, AS Ltd should invest in the machine from BC Ltd; (5 marks)

(b) calculate which of the following options AS Ltd would be financially better off to adopt:

Option 1 - Buy the machine and borrow the £60 000 from the bank, repaying at the end of each year a standard annual amount that would comprise principal and interest at 20% per annum;

or Option 2- Lease the machine for four years at an annual lease payment equal to the annual amount it would need to pay the bank under Option 1 above;

Show your calculations. (16 marks)

(c) recommend, with explanations, which of the two options in

(b) above AS ltd should adopt assuming that such a lease was available, but that it would not give AS Ltd the right to acquire the machine at the end of the lease period.

(4 marks)

Note: Assume that lease payments or loan repayments are made gross at the end of each year and that tax is paid and tax allowances received one year after those profits are earned.

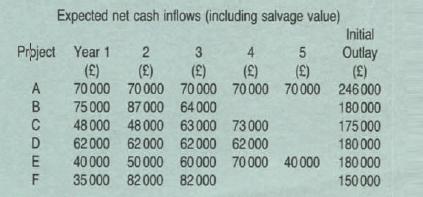

Advanced: Single period capital rationing Sanden Ltd is a highly geared company that wishes to expand its operations. Six possible capital investments have been identified, but the company only has access to a total of £620 000. The projects are not divisible and may not be postponed until a future period. After the projects end it is unlikely that similar investment opportunities will occur.

Projects A and E are mutually exclusive. All projects are believed to be of similar risk to the company's existing capital investments.

Any surplus funds may be invested in the money market to earn a return of 9% per year. The money market may be assumed to be an efficient market.

Sanden's cost of capital is 12% per year.

Required:

(a) Calculate:

(i) The expected net present value;

(ii) The expected profitability index associated with each of the six projects, and rank the projects according to both of these investment appraisal methods.

Explain briefly why these rankings differ. (8 marks)

(b) Give reasoned advice to Sanden Ltd recommending which projects should be selected. (6 marks)

(c) A director of the company has suggested that using the company's normal cost of capital might not be appropriate in a capital rationing situation. Explain whether you agree with the director. (4 marks)

(d) The director has also suggested the use of linear or integer programming to assist with the selection of projects. Discuss the advantages and disadvantages of these mathematical programming methods to Sanden Ltd

Step by Step Answer: