Advanced: NPV calculation and identification of incremental cash flows LKL pic is a manufacturer of sports equipment

Question:

Advanced: NPV calculation and identification of incremental cash flows LKL pic is a manufacturer of sports equipment and is proposing to start project VZ, a new product line. This project would be for the four years from the start of year 20X1 to the end of 20X4. There would be no production of the new product after 20X4.

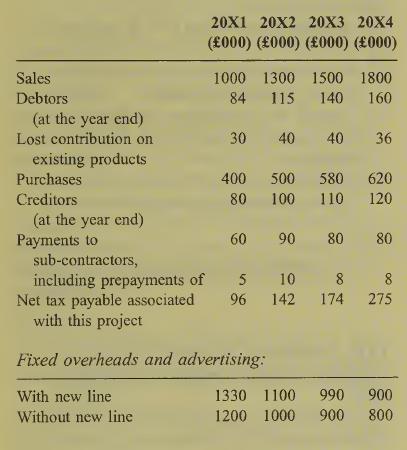

You have recently joined the company’s accounting and finance team and have been provided with the following information relating to the project:

Capital expenditure A feasibility study costing £45 000 was completed and paid for last year. This study recommended that the company buy new plant and machinery costing £1 640000 to be paid for at the start of the project. The machinery and plant would be depre¬ ciated at 20% of cost per annum and sold during year 20X5 for £242 000 receivable at the end of 20X5.

As a result of the proposed project it was also recommended that an old machine be sold for cash at the start of the project for its book value of £16000. This machine had been scheduled to be sold for cash at the end of 20X2 for its book value of £12000.

Other data relating to the new product line:

Notes • The year-end debtors and creditors are received and paid in the following year.

• The next tax payable has taken into account the effect of any capital allowances. There is a one year time-lag in the payment of tax.

• The company’s cost of capital is a constant 10% per annum.

• It can be assumed that operating cash flows occur at the year end.

• Apart from the data and information supplied there are no other financial implications after 20X4.

Labour costs From the start of the project, three employees currently working in another department and earn¬ ing £12000 each would be transferred to work on the new product line, and an employee currently earning £20 000 would be promoted to work on the new line at a salary of £30000 per annum. The effect on the transfer of employees from the other department to the project is included in the lost contribution figures given above.

As a direct result of introducing the new product line, four employees in another department currently earning £10000 each would have to be made redundant at the end of 20X1 and paid redundancy pay of £15 500 each at the end of 20X2.

Agreement had been reached with the trade unions for wages and salaries to be increased by 5% each year from the start of 20X2.

Material costs Material XNT which is already in stock, and for which the company has no other use, cost the company £6400 last year, and can be used in the manufacture of the new product. If it is not used the company would have to dispose of it at a cost to the company of £2000 in 20X1.

Material XPZ is also in stock and will be used on the new line. It cost the company £11 500 some years ago. The company has no other use for it, but could sell it on the open market for £3000 in 20X1.

Required

(a) Prepare and present a cash flow budget for project VZ, for the period 20X1 and 20X5 and calculate the net present value of the project. (14 marks)

(b) Write a short report for the board of directors which:

(i) explains why certain figures which were provided in

(a) were excluded from your cash flow budget, and (ii) advises them on whether or not the project should be undertaken, and lists other factors which would also need to be considered. (7 marks)

ACCA Paper 8 Managerial Finance

Step by Step Answer: