Advanced: Optimal output and shadow prices using the graphical approach Usine Ltd is a company whose objective

Question:

Advanced: Optimal output and shadow prices using the graphical approach Usine Ltd is a company whose objective is to maximize profits. It manufactures two speciality chemical powders, gamma and delta, using three processes: heating, refining and blending. The powders can be produced and sold in infinitely divisible quantities.

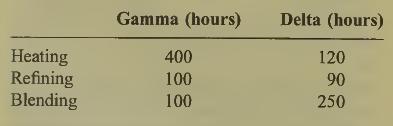

The following are the estimated production hours for each process per kilo of output for each of the two chemical powders during the period 1 June to 31 August:

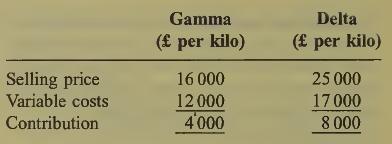

During the same period, revenues and costs per kilo of output are budgeted as

It is anticipated that the company will be able to sell all it can produce at the above prices, and that at any level of output fixed costs for the three month period will total £36000.

The company’s management accountant is under the impression that there will only be one scarce factor during the budget period, namely blending hours, which cannot exceed a total of 1050 hours during the period 1 June to 31 August. He therefore correctly draws up an optimum production plan on this basis.

However, when the factory manager sees the figures he points out that over the three month period there will not only be a restriction on blending hours, but in addition the heating and refining hours cannot exceed 1200 and 450 respec¬ tively during the three month period.

Requirements:

(a) Calculate the initial production plan for the period 1 June to 31 August as prepared by the management accountant, assuming blending hours are the only scarce factor. Indicate the budgeted profit or loss, and explain why the solution is the optimum. (4 marks)

(b) Calculate the optimum production plan for the period 1 June to 31 August, allowing for both the constraint on blending hours and the additional restrictions identified by the factory manager, and indicate the budgeted profit or loss. (8 marks)

(c) State the implications of your answer in

(b) in terms of the decisions that will have to be made by Usine Ltd with respect to production during the period 1 June to 31 August after taking into account all relevant costs.

(2 marks)

(d) Under the restrictions identified by the management accountant and the factory manager, the shadow (or dual) price of one extra hour of blending time on the optimum production plan is £27.50. Calculate the shadow (or dual) price of one extra hour of refining time. Explain how such information might be used by management, and in so doing indicate the limitations inherent in the figures. (6 marks)

Note: Ignore taxation

Step by Step Answer: