Advanced: Planning and operating variances A year ago Kenp Ltd entered the market for the manufacture and

Question:

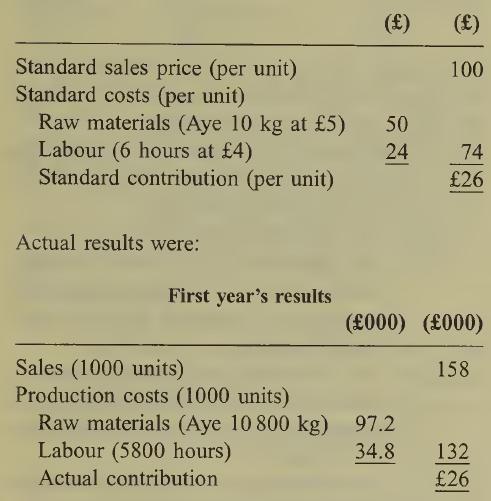

Advanced: Planning and operating variances A year ago Kenp Ltd entered the market for the manufacture and sale of a revolutionary insulating material. The budgeted production and sales volumes were 1000 units. The originally estimated sales price and standard costs for this new product were:

‘Throughout the year we attempted to operate as efficiently as possible, given the prevailing condi¬ tions’ stated the managing director. ‘Although in total the performance agreed with budget, in every detailed respect, expect volume, there were large differences. These were due, mainly, to the tremen¬ dous success of the new insulating material which created increased demand both for the product itself and all the manufacturing resources used in its production. This then resulted in price rises all round.’

‘Sales were made at what was felt to be the highest feasible price but, it was later discovered, our competitors sold for £165 per unit and we could have equalled this price. Labour costs rose dramatically with increased demand for the spe¬ cialist skills required to produce the product and the general market rate was £6.25 per hour- although Kenp always paid below the general market rate whenever possible.’

‘Raw material Aye was chosen as it appeared cheaper than the alternative material Bee which could have been used. The costs which were expected at the time the budget was prepared were (per kg): Aye, £5 and Bee, £6. However, the market prices relating to efficient purchases of the materials during the year were:

Therefore it would have been more appropriate to use Bee, but as production plans were based on Aye it was Aye that was used.’

‘It is not proposed to request a variance analysis for the first year’s results as most of the deviations from budget were caused by the new product’s great success and this could not have been fully anticipated and planned for. In any event the final contribution was equal to that originally budgeted so operations must have been fully efficient.’

Required:

(a) Compute the traditional variances for the first year’s operations. (5 marks)

(b) Prepare an analysis of variances for the first year’s operations which will be useful in the circumstances of Kenp Ltd. The analysis should indicate the extent to which the variances were due to operational efficiency or planning causes. (10 marks)

(c) Using, for illustration, a comparison of the raw material variances computed in

(a) and

(b) above, briefly outline two major advantages and two major disadvantages of the approach applied in part

(b) over the traditional approach.

Step by Step Answer: