Advanced: Reapportionment of service department costs and comments on apportionment and absorption calculation The Isis Engineering Company

Question:

Advanced: Reapportionment of service department costs and comments on apportionment and absorption calculation The Isis Engineering Company operates a job order costing system which includes the use of predeter¬ mined overhead absorption rates. The company has two service cost centres and two production cost centres. The production cost centre overheads are charged to jobs via direct labour hour rates which are currently £3.10 per hour in production cost centre A and £11.00 per hour in production cost centre B. The calculations involved in determining these rates have excluded any consideration of the services that are provided by each service cost centre to the other.

The bases used to charge general factory over¬ head and service cost centre expenses to the production cost centres are as follows:

(i) general factory overhead is apportioned on the basis of the floor area used by each of the production and service cost centres,

(ii) the expenses of service cost centre 1 are charged out on the basis of the number of personnel in each production cost centre,

(iii) the expenses of service cost centre 2 are charged out on the basis of the usage of its services by each production cost centre.

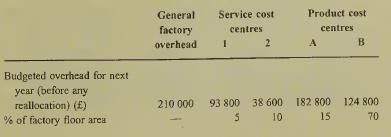

The company’s overhead absorption rates are revised annually prior to the beginning of each year, using an analysis of the outcome of the current year and the draft plans and forecasts for the forthcoming year. The revised rates for next year are to be based on the following data:

(a) Ignoring the question of reciprocal charges between the service cost centres, you are required to calculate the revised overhead absorption rates for the two production cost centres. Use the company’s established procedures. (6 marks)

(b) Comment on the extent of the differences between the current overhead absorption rates and those you have calculated in your answer to (a). Set out the likely reasons for these differences. (4 marks)

(c) Each service cost centre provides services to the other. Recalculate next year’s overhead absorption rates, recognizing the existence of such reciprocal services and assuming that they can be measured on the same bases as those used to allocate costs to the production cost centres. (6 marks)

(d) Assume that:

(i) General factory overhead is a fixed cost.

(ii) Service cost centre 1 is concerned with inspection and quality control, with its budgeted expenses (before any realloca¬ tions) being 10% fixed and 90% vari¬ able.

(iii) Service cost centre 2 is the company’s plant maintenance section, with its budgeted expenses (before any realloca¬ tions) being 90% fixed and 10% vari¬ able.

(iv) Production cost centre A is labour- intensive, with its budgeted overhead (before any reallocation) being 90% fixed and 10% variable.

(v) Production cost centre B is highly mechanized, with its budgeted overhead (before any reallocations) being 20% fixed and 80% variable.

In the light of these assumptions, comment on the cost apportionment and absorption calculations made in parts

(a) and

(c) and suggest any improvements that you would consider appropriate.

Step by Step Answer: