Advanced: Relevant cash flows and appraising an overseaslnvesbnent Hempel PLC is considering setting up a production facility

Question:

Advanced: Relevant cash flows and appraising an overseaslnvesbnent Hempel PLC is considering setting up a production facility overseas in order to supply a market which it could not otherwise supply.

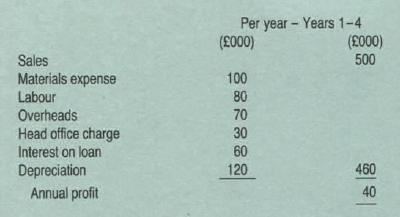

Sales and costs of the venture on an accounting basis, all expressed in £ Sterling, are:

All sales and purchases of materials are for cash. Initial stocks of materials, required at the start of the project, will be £40000. End of year stock levels will be £60 000 for years 1, 2 and 3 but zero at year4 .

'labour' and 'Overheads' are incremental cash costs paid in the years to which they relate . 'Head office charge' is an apportionment of UK head office costs which, in total, will not be changed by acceptance of this proposal. 'Interest' relates to the loan used to finance this project - all cash flows relating to the loan occur in the UK. 'Head office charge' and ' Interest' are the only expenses of the project paid in the UK.

'Depreciation 's is based on the straight-line method. Initial oost of fixed assets is £600 000 and the year 4 salvage value is estimated to be £120 000.

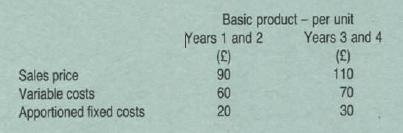

If the project goes ahead then Hempel will suffer a small reduction in its UK manufactured exports to those areas which have objections to Hempel 's economic involvement with the country chosen for the siting of the new manufacturing venture. This will result in Hempel losing sales of 1000 units of its basic product in each of years 1 to 4. Financial details , per unit, of the basic product are :

Included in 'Variable costs· is £15 relating to material X; this is the cost which Hempel has contracted to pay for each unit of this material. However, until the end of year 3, material X will be in short supply and any available quantities could be used elsewhere in Hempel to earn a contribution of £1 0 per unit in excess of cost.

From year 4 material X will not be in short supply.

Hempel is unsure whether its proposed overseas project will be the only project it undertakes in that country or the start of a massive, long-term investment there . While cash flows from the project can be used for further investment in that country without restriction , cash flows for remittance to the UK are currently subject to the following restrictions:

(i) no cash can be remitted until 2 years after commencement of the project (ii ) from year 2 cash remittances are limited to a yearly maximum of 30 % of the initial investment in fixed assets ;

(iii) all cash which cannot be immediately remitted - and which is not to be used to finance investment in the country - must be deposited , at zero interest, until the 30% limit permits remittance to the UK;

(iv) the limit of 30% applies to all cash flows from the project to the UK and includes any reimbursement of valid expenses initially paid In the UK as well as remittances of final salvage value of equipment.

These rules , which can result in cash from a project being remitted to the UK for many years after a project has ceased operating, are thought likely to apply for at least 8 but no more than 12 years -

thereafter cash can be freely remitted . The exchange rate has been and is expected to be stable against Sterling.

All cash flows occur at the end of the year to which they relate, with the exception of the cost of the fixed assets and the cost of the initial stocks of materials, both of which will occur at the start of the first year. The required rate of return lor the project is 15%.

Required :

(a) Ignoring taxation, determine the net present value of Hempel 's project in each of the follo wing separate conditions :

(i) Hempel will be pursuing a policy of substantial investment in the overseas country for the next 15 years . all cash flows from the project will be utilized for reinvestment and will reduce cash required to be remitted from the UK to facilitate Hempel 's investment plans.

(ii) Hempel will not be investing further in the overseas country and requires the project's cash flows to be remitted to the UK at the earliest opportunity.

(13 marks)

(b) Describe, and indicate the rmportance of, the additional factors which should be considered when appraising an overseas, rather than a domestic, capital investment.

Step by Step Answer: