Advanced: Relevant cash flows and calculation of NPV A holding company owns a shipbuilding subsidiary which will

Question:

Advanced: Relevant cash flows and calculation of NPV A holding company owns a shipbuilding subsidiary which will show a loss on its 1982 operations. At present it has no future orders on hand. The directors are considering selling the shipyard plus plant and machinery. A firm offer has been received to purchase at 31 December 1982 for £120000.

However, since the sale discussions were started a contract has been offered to the company to build three ships. These would be for delivery at the rate of one a year commencing 31 December 1983 at a fixed price of £250 000 each. Their building would use the complete resources of the shipyard.

You are required from the data given below to:

(a) calculate whether there is a financial incentive to acc~pt the shipbuilding contract if the cost of capital for the next three years were to be 12%, 16% or 20%

(b) comment on the figures you have used in your calculations;

(c) state whether you consider the shipbuilding contract should be undertaken assuming that the directors assess the probability of the interest rate for the construction period to be 0.5 for 12%,0.4 for 16% and 0.1 for 20%.

Data:

Fixed assets: The shipyard and equipment were purchased 7 years ago on a 10-year lease for £400000. The book value at 31 December 1982 will be £120 000.

Labour: The estimated labour cost per ship is £120 000 based on forecast wage rates as at1 January 1983. Labour rates are expected to rise by 10% per year.

If the yard closes at 31 December 1982, then pay in lieu of notice plus redundancy payments are expected to equal one year's labour cost. These payments would be spread evenly over the year. By the end of the third year, other jobs will be available to absorb the manpower.

Materials: Sufficient material js in stock to build the first ship. This was purchased two years ago for £80 000 but current replacement cost is £100000. Prices are expected to rise by 8% per annum. Orders for further materials must be placed ahead of the year in which the material is used in construction. It is paid for on 31 December of the year of purchase. If not used the material in stock has a current scrap value of £25 000 but will deterioriate and be valueless in three years' time.

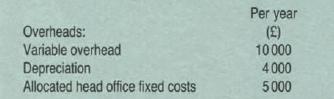

Variable overhead and head office fixed costs are expected to increase by 1 0% per year.

Sales realizations: Realizations from the sale of the shipyard and equipment, the material stock and the new ships would be received on 31 December.

Cost of capital: The cost of capital is currently 12% per annum but the company may wish to earn up to 20% on the contract if it is taken.

Taxation can be ignored and all calculations should be made to the nearest £000.

Step by Step Answer: