Advanced: Relevant costs for a pricing decision A company had nearly completed a specialized piece of capital

Question:

Advanced: Relevant costs for a pricing decision A company had nearly completed a specialized piece of capital equipment when it discovered that its customer had gone out of business. After searches, two other possible customers (E Ltd and P Ltd) for the equipment were found who might be interested subject to certain modifications being carried out.

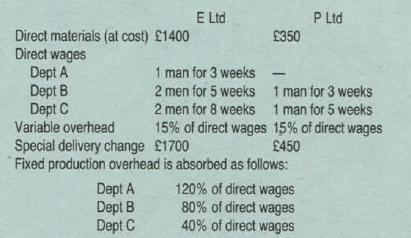

E Ltd wanted the equipment to be completed to its original specification and then certain extra features to be added. P Ltd wanted the equipment in its present condition but without its control mechanism and with certain modifications. The costs of these additions and modifications were:

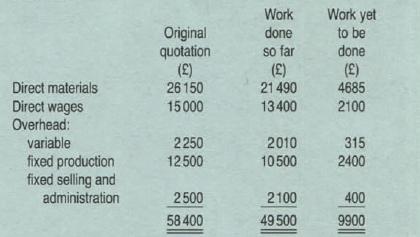

The costs of the equipment as originally estimated and incurred so far were:

The price to the original customer allowed for a profit margin of 20% on selling price. An advance payment of 15% of the price had been received when the order had been confirmed.

The following additional information is related to the possible conversions:

1. Direct matenals for the additions for E Ltd would need to be bought from suppliers, but those for modifications for P Ltd are in stock and, if not used for P Ltd, would be used on another contract in place of materials that would now cost £750.

2. The wage rate in Dept A is £140 per man per week. This department is slack at present but, to ensure the availability of skilled personnel, it must keep three men on its payroll even though the current and projected load for the next few months is only 50% of capacity.

3. Dept B is working normally and its wage rate is £120 per man per week.

4. Dept Cis extremely busy. Its wage rate is £100 per man per week and it is currently yielding a contribution to overhead and profit of £3.20 per £1 of direct labour.

5. If the work for either E Ltd or P Ltd is undertaken , supervising overtime of £500 and £350 respectively would be incurred Such costs are normally charged to fixed production overhead.

6. The cost of the control mechanism that P Ltd does not require was £4500. If taken out (at a cost of 1 man-week 's work in Dept B), it could be used on another contract in place of a different mechanism which could be bought for £3500.

If neither of the conversions is carried out, some of the materials in the original equipment could be used on another contract in place of materials that would have cost £4000, but would need 2 manweeks of work in Dept B to make them suitable. The remaining matenals would realize £3800 as scrap. The draWings for the equipment. which woud normally be tncluded in the selling price, could be sold for £500.

You are required to calculate ·

(a) the minimum price that the company should accept from P Ltd for the converted machine ;

(b) the minimum price at which it would be more advantageous to sell to E Ltd if the company received an offer from P Ltd of £18000 for the converted machine.

Expla1n clearly how you reach your recommended figures .

Step by Step Answer: