Advanced: Selling price decision based on expected values and value of additional information Warren Ltd is to

Question:

Advanced: Selling price decision based on expected values and value of additional information Warren Ltd is to produce a new product in a short¬ term venture which will utilize some obsolete materials and expected spare capacity. The new product will be advertised in quarter I with produc¬ tion and sales taking price in quarter II. No further production or sales are anticipated.

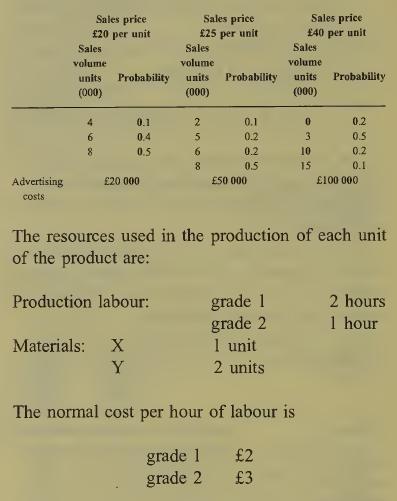

Sales volumes are uncertain but will, to some extent, be a function of sales price. The possible sales volumes and the advertising costs associated with each potential sales price are as follows:

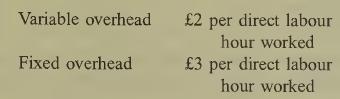

However, before considering the effects of the current venture, there is expected to be 4000 hours of idle time for each grade of labour in quarter II. Idle time is paid at the normal rates.

Material X is in stock at a book value of £8 per unit, but is widely used within the firm and any usage for the purposes of this venture will require replacing. Replacement cost is £9 per unit.

Material Y is obsolete stock. There are 16000 units in stock at a book value of £3.50 per unit and any stock not used will have to be disposed of at a cost, to Warren, of £2 per unit. Further quantities of Y can be purchased for £4 per unit.

Overhead recovery rates are

Total fixed overheads will not alter as a result of the current venture.

Feedback from advertising will enable the exact demand to be determined at the end of quarter I and production in quarter II will be set to equal that demand. However, it is necessary to decide now on the sales price in order that it can be incorporated into the advertising campaign.

Required:

(a) Calculate the expected money value of the venture at each sales price and on the basis of this advise Warren of its best course of action.

(12 marks)

(b) Briefly explain why the management of Warren might rationally reject the sales price leading to the highest expected money value and prefer one of the other sales prices.

(4 marks)

(c) It will be possible, for the sales price of £40 per unit only, to ascertain which of the four levels of demand will eventuate. If the indica¬ tions are that the demand will be low then the advertising campaign can be cancelled at a cost of £10000 but it would then not be possible to continue the venture at another sales price. This accurate information concerning demand will cost £5000 to obtain.

Indicate whether it is worthwhile obtaining the information and ascertain whether it would alter the advice given in

(a) above.

(4 marks) (Total 20 marks) ACCA Level 2 Management Accounting 12.13* Advanced: Expected value, maximin and regret criterion Stow Health Centre specialises in the provision of sports/exercise and medical/dietary advice to clients. The service is provided on a residential basis and clients stay for whatever number of days suits their needs.

Budgeted estimates for the next year ending 30 June are as follows:

(i) The maximum capacity of the centre is 50 clients per day for 350 days in the year.

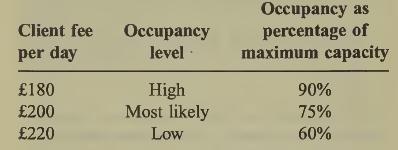

(ii) Clients will be invoiced at a fee per day. The budgeted occupancy level will vary with the client fee level per day and is estimated at different percentages ofmaximum capacity as follows:

(iii)Variable costs are also estimated at one of three levels per client day. The high, most likely and low levels per client day are £95, £85 and £70 respectively.

The range of cost levels reflect only the possible effect of the purchase prices of goods and services.

Required:

(a) Prepare a summary which shows the budgeted contribution earned by Stow Health Centre for the year ended 30 June for each of nine possible outcomes. (6 marks)

(b) State the client fee strategy for the next year to 30 June which will result from the use of each of the following decision rules: (i) maximax; (ii) maximin; (iii) minimax regret.

Your answer should explain the basis of operation of each rule. Use the information from your answer to

(a) as relevant and show any additional working calculations as neces¬ sary. (9 marks)

(c) The probabilities of variable cost levels occur¬ ring at the high, most likely and low levels provided in the question are estimated as 0.1, 0.6 and 0.3 respectively.

Using the information available, determine the client fee strategy which will be chosen where maximisation of expected value of contribu¬ tion is used as the decision basis. (5 marks)

(d) The calculations in

(a) to

(c) concern contri¬ bution levels which may occur given the existing budget.

Stow Health Centre has also budgeted for fixed costs of £ 1 200 000 for the next year to 30 June.

Discuss ways in which Stow Health Centre may instigate changes, in ways other than through the client fee rate, which may influ¬ ence client demand, cost levels and profit.

Your answer should include comment on the existing budget and should incorporate illustrations which relate to each of four addi¬ tional performance measurement areas appro¬ priate to the changes you discuss.

Step by Step Answer: