Advanced: Single and multi-period capital rationing Raiders Ltd is a private limited company which is financed entirely

Question:

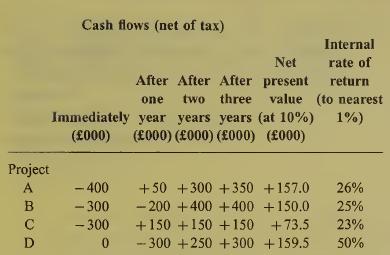

Advanced: Single and multi-period capital rationing Raiders Ltd is a private limited company which is financed entirely by ordinary shares. Its effective cost of capital, net of tax, is 10% per annum. The directors of Raiders Ltd are considering the com¬ pany’s capital investment programme for the next two years, and have reduced their initial list of projects to four. Details of the projects are as follows:

None of the projects can be delayed. All projects are divisible; outlays may be reduced by any proportion and net inflows will then be reduced in the same proportion. No project can be under¬ taken more than once. Raiders Ltd is able to invest surplus funds in a bank deposit account yielding a return of 7% per annum, net of tax.

You are required to:

(a) prepare calculations showing which projects Raiders Ltd should undertake if capital for immediate investment is limited to £500000, but is expected to be available without limit at a cost of 10% per annum thereafter;

(5 marks)

(b) provide a mathematical programming formu¬ lation to assist the directors of Raiders Ltd in choosing investment projects if capital avail¬ able immediately is limited to £500000, cap¬ ital available after one year is limited to £300000, and capital is available thereafter without limit at a cost of 10% per annum;

(8 marks)

(c) outline the limitations of the formulation you have provided in (b); (6 marks)

(d) comment briefly on the view that in practice capital is rarely limited absolutely, provided that the borrower is willing to pay a suffi¬ ciently high price, and in consequence a technique for selecting investment projects which assumes that capital is limited abso¬ lutely, is of no use.

(6 marks) (Total 25 marks) ICAEW Financial Management

Step by Step Answer: