Advanced: Single period capital rationing Banden Ltd is a highly geared company that wishes to expand its

Question:

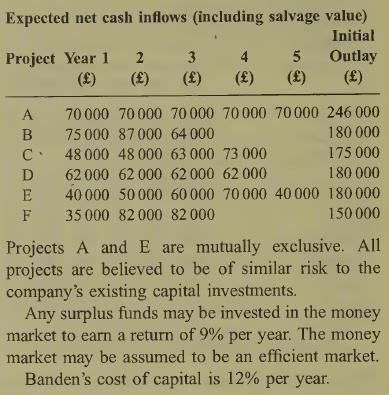

Advanced: Single period capital rationing Banden Ltd is a highly geared company that wishes to expand its operations. Six possible capital investments have been identified, but the company only has access to a total of £620 000. The projects are not divisible and may not be postponed until a fixture period. After the projects end it is unlikely that similar investment opportunities will occur.

Required:

(a) Calculate:

(i) The expected net present value;

(ii) The expected profitability index asso¬ ciated with each of the six projects, and rank the projects according to both of these investment appraisal methods.

Explain briefly why these rankings differ. (8 marks)

(b) Give reasoned advice to Banden Ltd recom¬

mending which projects should be selected.

(6 marks)

(c) A director of the company has suggested that using the company’s normal cost of capital might not be appropriate in a capital rationing situation. Explain whether you agree with the director. (4 marks)

(d) The director has also suggested the use of linear or integer programming to assist with the selection of projects. Discuss the advan¬ tages and disadvantages of these mathematical programming methods to Banden Ltd.

(7 marks) (Total 25 marks) ACCA Level 3 Financial Management

Step by Step Answer: