Advanced: The application of the learning curve to determine target cash flows Leano pic is investigating the

Question:

Advanced: The application of the learning curve to determine target cash flows Leano pic is investigating the financial viability of a new product X. Product X is a short life product for which a market has been identified at an agreed design specification. It is not yet clear whether the market life of the product will be six months or 12 months.

The following estimated information is available in respect of product X:

(i) Sales should be 10000 units per month in batches of 100 units on a just-in-time produc¬ tion basis. An average selling price of £1200 per batch of 100 units is expected for a six month life cycle and £1050 per batch of 100 units for a 12 month life cycle.

(ii) An 80% learning curve will apply in months 1 to 7 (inclusive), after which a steady state production time requirement will apply, with labour time per batch stabilising at that of the final batch in month 7. Reductions in the labour requirement will be achieved through natural labour turnover. The labour require¬ ment for the first batch in month 1 will be 500 hours at £5 per hour.

(hi) Variable overhead is estimated at £2 per labour hour.

(iv) Direct material input will be £500 per batch of product X for the first 200 batches. The next 200 batches are expected to cost 90% of the initial batch cost. All batches thereafter will cost 90% of the batch cost for each of the second 200 batches.

(v) Product X will incur directly attributable fixed costs of £15 000 per month.

(vi) The initial investment for the new product will be £75 000 with no residual value irrespective of the life of the product.

A target cash inflow required over the life of the product must be sufficient to provide for:

(a) the initial investment plus 33 1/3% thereof for a six month life cycle, or

(b) the initial investment plus 50% thereof for a 12 month life cycle.

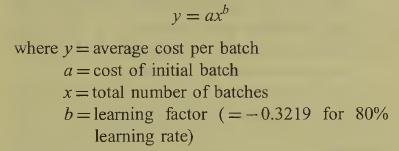

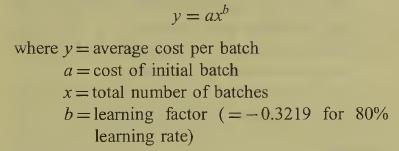

Note: learning curve formula:

Required:

(a) Prepare detailed calculations to show whether product X will provide the target cash inflow over six months and/or 12 months.

(17 marks)

(b) Calculate the initial batch labour hours at which the cash inflow achieved will be exactly equal to the target figure where a six month life cycle applies. It has been determined that the maximum labour and variable overhead cost at which the target return will be achieved is £259000. All other variables remain as in part (a). (6 marks)

(c) Prepare a report to management which:

(i) explains why the product X proposal is an example of a target costing/pricing situation; (3 marks)

(ii) suggests specific actions which may be considered to improve the return on investment where a six month product cycle is forecast; (6 marks)

(iii) comments on possible factors which could reduce the rate of return and which must, therefore, be avoided.

(3 marks) (Total 35 marks) ACCA Paper 9 Information for Control and Decision Making

Step by Step Answer: