Advanced: Variance calculations and reconciliation of budgeted and actual profit Bamffam pic is a well established manufacturer

Question:

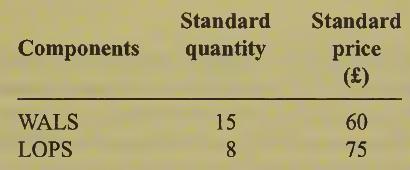

Advanced: Variance calculations and reconciliation of budgeted and actual profit Bamffam pic is a well established manufacturer of a specialized product, a Wallop, which has the following specifications for production:

The standard direct labour hours to produce a Wallop at the standard wage rate of £10.50 per hour has been established at 60 hours per Wallop.

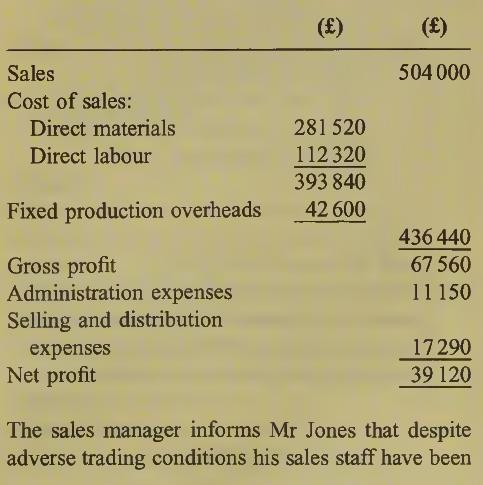

The annual fixed overhead budget is divided into calendar months with equal production per month. The budgeted annual fixed overheads are £504 000 for the budgeted output of 2400 Wallops per annum.

Mr Jones, a marketing person, is now the managing director of Bamffam pic and must report to the board of directors later this day and he seeks your advice in respect of the following operating information for the month of May:

able to sell 180 Wallops at the expected standard selling price.

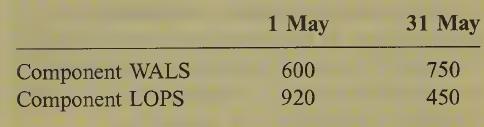

The production manager along with the purchasing department manager are also pleased that prices for components have been stable for the whole of the current year and they are able to provide the following information:

Stocks for May are as follows:

The actual number of direct labour hours worked in May was 11 700, considerably less than the produc¬ tion manager had budgeted. Further, the purchas¬ ing manager advised that WALS had cost £171 000 at a price of £57 per unit in the month of May and 1000 LOPS had been acquired for £81 000.

Mr Jones, eager to please the board of directors, requests you, as the newly appointed management accountant, to prepare appropriate statements to highlight the following information which is to be presented to the board:

(a) The standard product cost of a Wallop.

(3 marks)

(b) (i) The direct material variances for both price and usage for each component used in the month of May assuming that prices were stable throughout the relevant period.

(ii) The direct labour efficiency and wage rate variances for the month of May.

(iii) The fixed production overhead expendi¬ ture and volume variances.

Note: You may assume that during the month of May there is no change in the level of finished goods stocks.

(10 marks)

(c) A detailed reconciliation statement of the standard gross profit with the actual gross profit for the month of May. (4 marks)

(d) Draft a brief report for Mr Jones that he could present to the board of directors on the useful¬ ness, or otherwise, of the statement you have prepared in your answer to

(c) above.

(5 marks) (Total 22 marks) ACCA Level 2 Management Accounting

Step by Step Answer: