Advanced: Various aspects of divisional performance evaluation and transfer pricing involving the algebraic manipulation of figures to

Question:

Advanced: Various aspects of divisional performance evaluation and transfer pricing involving the algebraic manipulation of figures to identify likely outcomes Scenario Chambers pic produces motor components and a vehicle called the Rambler. The company is split into three operating divisions - Engines, Transmis¬ sions and Assembly. The Rambler is produced in the Assembly division. Each Rambler incorporates an engine produced in the Engines division and a transmission system produced in the Transmissions division.

Each operating division is both a profit and an investment centre, with the performance of divi¬ sional managers assessed on return on capital employed (ROCE) achieved. In addition to their salary, each manager is paid a bonus each year linked to ROCE achieved in the current year. Chambers pic is financed by various means and has an average cost of capital of 7% per annum.

Relevant details concerning the three operating divisions in the coming year are as follows:

Engines division:

• The variable cost of engine production is £600 per unit.

• Annual demand from outside customers for engines varies with price: it is 5000 units at unit price £1000 and changes by 5 units with each £1 change in unit price.

• Fixed costs are £5 000 000 per year, and capital employed is £5 200 000.

Transmissions division:

• The variable cost of transmission unit production is £350 per unit.

• Annual demand from outside customers for transmission units varies with price: it is 2500 units at unit price £1200 and changes by 5 units with each £2 change in unit price.

• Fixed costs are £5 200000 per year, and capital employed is £8 100000.

Assembly division:

• The variable cost (excluding transfer charges) of Rambler production is £1500 per unit.

• Annual demand for ramblers varies with price: it is 4000 units at a unit price of £6000 and changes by 2 units with each £1 change in unit price.

• Fixed costs are £5 800000 per year, and capital employed is £10200000.

There are no capacity constraints in any of the divisions.

Chambers pic’s transfer pricing policy is that goods transferred between divisions should be at the price charged to outside customers for the relevant units. In setting selling prices to outside customers, the Engines and Transmissions divisions must ignore the effect of transfers to the Assembly division. The manager of the Assembly division treats transfer prices for units received as variable costs.

An investment in new equipment (having a life of 5 years and a residual value of nil) is being considered by the management of the Transmis¬ sions division. The equipment would cost £850 000 and would reduce the variable cost per transmission unit by £30.

Part One Requirements:

(a) Calculate for each division the output, product price, profit and ROCE that is likely to emerge, given the existing transfer pricing system and assuming that each divisional manager will act to maximise the ROCE of his/her own division.

Ignore the investment in new equipment.

(7 marks)

(b) Determine and state the optimum output level and selling price for each division from the point of view of Chambers pic as a whole. Prepare a statement showing the resultant profit and ROCE of each division, assuming that the existing transfer policy system remains in place.

Ignore the investment in new equipment.

(7 marks)

(c) Prepare a financial analysis to show the impact of the investment in new equipment on the profit and ROCE of the three divisions, given the existing transfer pricing and per¬ formance appraisal systems. State whether or not the management of the Transmissions division is likely to adopt the proposed new investment. (6 marks)

(d) State whether or not the proposed new invest¬ ment is to the advantage of Chambers pic as a whole, assuming that decisions concerning output, etc. continue to be determined by the existing transfer pricing and performance appraisal systems.

Support your answer with a discounted cash flow analysis. (5 marks)

Note: The following information is given to illustrate a methodology that might be used to solve the requirements of the question:

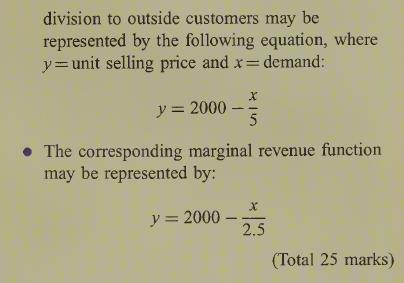

• The demand function for sales by the Engines

Part Two The concept of divisional organisation is to place divisional managers in the same risk/reward position as independent entrepreneurs. In theory, this induces divisional managers to act in a manner calculated to maximise the wealth of the company’s shareholders. This may or may not work in practice but you may be sure of one thing - divisional organisation creates a lot of employment for chartered management accountants.

Requirements:

Having regard to the above statement,

(a) explain how the divisional performance appraisal and transfer pricing systems at Chambers pic might contribute to maximising the wealth of shareholders; (7 marks)

(b) explain the limitations of ROCE as a divi¬

sional performance indicator, and suggest alternative measures that might be more effec¬ tive; (7 marks)

(c) explain why and how the concept behind divisional organisation might be extended into many areas of govemment/public service; (5 marks)

(d) explain why divisional organisation generates work for management accountants, and suggest actions which might be taken to make such work cost-effective. (6 marks)

(Total 25 marks)

Part Three An effective transfer pricing system in the context of a divisional organisation has to satisfy several basic criteria. The problem is that nobody has yet invented a system of transfer pricing that is capable of doing this with perfection.

Requirements:

Having regard to the above statement,

(a) explain what criteria an effective system of transfer pricing has to satisfy; (7 marks)

(b) state how far the system used by Chambers pic meets the criteria you have identified in your answer to (a); advise Chambers pic on how it might modify its transfer pricing system in order to make it more effective.

(9 marks)

(c) explain the features of transfer pricing systems based on (i) marginal cost, (ii) opportunity cost, and (iii) cost plus;

state how far each of these systems meets the criteria you have identified in your answer to requirement (a).

Step by Step Answer: