Alternative joint-cost-allocation methods, further process decision. (40 minutes) Jeronimos, Lda, produces two products, turpentine and methanol (wood

Question:

Alternative joint-cost-allocation methods, further process decision. (40 minutes) Jeronimos, Lda, produces two products, turpentine and methanol (wood alcohol), by a joint process. Joint costs amount to EUR 120,000 per batch of output. Each batch totals 40,000 litres: 25%

methanol and 75% turpentine. Both products are processed further without gain or loss in volume. Separable processing costs include: methanol, EUR 0.75 per litre; and turpentine, EUR 0.5 per litre. Methanol sells for EUR 5.25 per litre; turpentine sells for EUR 3.5 per litre.

REQUIRED 1. What joint costs per batch should be allocated to the turpentine and methanol, assuming that joint costs are allocated on a physical measure

(number of litres at split-off point) basis?

6-20 If joint costs are to be assigned on an estimated NRV basis, what amounts of joint cost should be assigned to the turpentine and to the methanol?

Prepare product-line income statements per batch for requirements 1 and 2.

Assume no beginning or ending stocks.

The company has discovered an additional process by which the methanol

(wood alcohol) can be made into a pleasant tasting alcoholic beverage. The new selling price would be EUR 15 per litre. Additional processing would increase separable costs by EUR 2.25 per litre (in addition to the EUR 0.75 separable cost required to yield methanol). The company would have to pay excise taxes of 20% on the new selling price. Assuming no other changes in cost, what is the joint cost applicable to the wood alcohol (using the estimated NRV method)? Should the company use the new process?

Alternative methods of joint-cost allocation, product-mix decisions. (40 minutes) Schmidsendl, GmbH, buys crude vegetable oil.

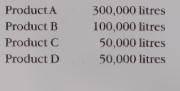

Refining this oil results in four products at the split-off point: A, B,C and D. Product C is fully processed at the split-off point. Products A, B and D can be individually further refined into Super A, Super B and.Super D. In the most recent month (December), the output at the split-off point was

The joint costs of purchasing the crude vegetable oil and processing it were EUR 100,000.

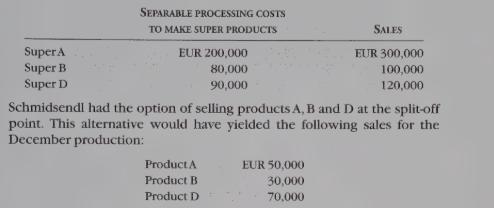

Schmidsendl had no beginning or ending stocks. Sales of product C in December were EUR 50,000. Total output of products A, B and D was further refined and then sold. Data related to December are as follows:

REQUIRED 1. What is the gross-margin percentage for each product sold in December, using the following methods for ailocating the EUR 100,000 joint costs:

(a) sales value at split-off,

(b) physical measure and (Cc) estimated NRV?

2. Could Schmidsendl have increased its December operating profit by making different decisions about the further refining of products A, B or D? Show the effect on operating profit of any changes you recommend. kio5

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster