Alternative methods of joint-cost allocation, product-mix decisions (40 minutes) Schmidsendl GmbH buys crude vegetable oil. Refining this

Question:

Alternative methods of joint-cost allocation, product-mix decisions (40 minutes)

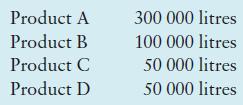

Schmidsendl GmbH buys crude vegetable oil. Refining this oil results in four products at the splitoff point: A, B, C and D. Product C is fully processed at the split-off point. Products A, B and D can be individually further refined into Super A, Super B and Super D. In the most recent month

(December), the output at the split-off point was: 6.21 Alternative methods of joint-cost allocation, product-mix decisions (40 minutes)

Schmidsendl GmbH buys crude vegetable oil. Refining this oil results in four products at the splitoff point: A, B, C and D. Product C is fully processed at the split-off point. Products A, B and D can be individually further refined into Super A, Super B and Super D. In the most recent month

(December), the output at the split-off point was:

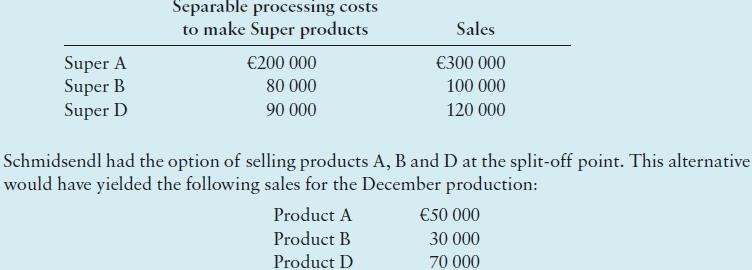

The joint costs of purchasing the crude vegetable oil and processing it were €100 000.

Schmidsendl had no beginning or ending stocks. Sales of product C in December were €50 000.

Total output of products A, B and D was further refined and then sold. Data related to December are as follows:

Required 1 What is the gross-margin percentage for each product sold in December, using the following methods for allocating the €100 000 joint costs:

(a) sales value at split-off,

(b) physical measure, and

(c) estimated NRV?

2 Could Schmidsendl have increased its December operating profit by making different decisions about the further refining of products A, B or D? Show the effect on operating profit of any changes you recommend.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan