BBG Corporation is a manufacturer of a synthetic element. Gary Voss, President of the company, has been

Question:

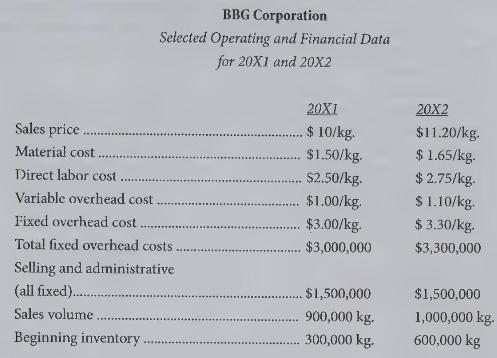

BBG Corporation is a manufacturer of a synthetic element. Gary Voss, President of the company, has been eager to get the operating results for the just completed fiscal year. He was surprised when the income statement revealed that income before taxes has dropped to \(\$ 885,000\) from \(\$ 900,000\) even though sales volume had increased 100,000 \(\mathrm{kg}\). This drop in net income had occurred even though Voss had implemented the following changes during the past 12 months to improve the profitability of the company.

- In response to a \(10 \%\) increase in production costs, the sales price of the company's product was increased by \(12 \%\). This action took place on December \(1,20 \mathrm{X} 1\).

- The managements of the selling and administrative departments were given strict instructions to spend no more in fiscal 20X2 than in fiscal 20X1.

- BBG's accounting department prepared and distributed to top management the comparative income statements presented below. The accounting staff also prepared related financial information to assist management in evaluating the company's performance. BBG uses the FIFO inventory method for finished goods.

Required:

(a) Explain to Gary Voss why BBG Corporation's net income decreased in the current fiscal year despite the sales price and sales volume increases.

(b) A member of BBG's accounting department has suggested that the company adopt variable (direct) costing for internal reporting purposes.

1. Prepare an operating income statement through income before taxes for the year ended November 30, 20X2, for BBG Corporation using the variable costing method.

2. Present a numerical reconciliation of the difference in income before taxes using the absorption costing method as currently employed by BBG and the variable costing method as proposed.

(c) Identify and discuss the advantages and disadvantages of using the variable costing method for internal reporting purposes.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline