Bires Ronsard SA recently purchased a brewing plant from a bankrupt company. The brewery is in Montpazier,

Question:

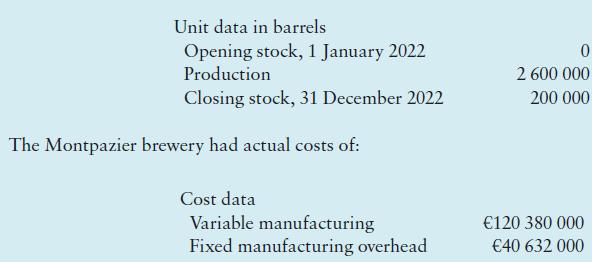

Bières Ronsard SA recently purchased a brewing plant from a bankrupt company. The brewery is in Montpazier, France. It was constructed only two years ago. The plant has budgeted fixed manufacturing overhead of €42 million (€3.5 million each month) in 2022. Alain Cassandre, the accountant of the brewery, must decide on the denominator-level concept to use in its absorption costing system for 2022. The options available to him are:

a Theoretical capacity: 600 barrels an hour for 24 hours a day × 365 days = 5 256 000 barrels.

b Practical capacity: 500 barrels an hour for 20 hours a day × 350 days = 3 500 000 barrels.

c Normal utilisation for 2022: 400 barrels an hour for 20 hours a day × 350 days = 2 800 000 barrels.

barrels.

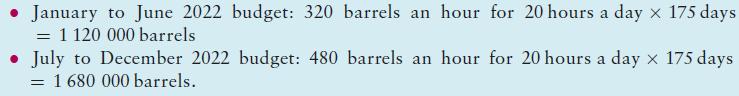

d Master-budget utilisation for 2022 (separate rates calculated for each half-year):

Variable standard manufacturing costs per barrel are €45 (variable direct materials, €32; variable manufacturing labour, €6; and variable manufacturing overhead, €7). The Montpazier brewery ‘sells’ its output to the sales division of Bières Ronsard at a budgeted price of €68 per barrel.

Required 1 Calculate the budgeted fixed manufacturing overhead rate using each of the four denominator-

level concepts for

(a) beer produced in March 2022 and

(b) beer produced in September 2022. Explain why any differences arise.

2 Explain why the theoretical capacity and practical capacity concepts are different.

3 Which denominator-level concept would the plant manager of the Montpazier brewery prefer when senior management of Bières Ronsard is judging plant manager performance during 2022? Explain.

The sales division of Bières Ronsard purchased 2 400 000 barrels in 2022 at the €68 per barrel rate.

All manufacturing variances are written off to cost of goods sold in the period in which they are incurred.

Required 1 Calculate the operating profit of the Montpazier brewery using the following:

(a) theoretical capacity,

(b) practical capacity and

(c) normal utilisation denominator-level concepts. Explain any differences among (a),

(b) and (c).

2 What denominator-level concept would Bières Ronsard prefer for income tax reporting?

Explain.

3 Explain the ways in which the tax office might restrict the flexibility of a company like Bières Ronsard, which uses absorption costing, to reduce its reported taxable income.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan