Ceder Ltd has details of two machines that could fulfil the company's future production plans. Only one

Question:

Ceder Ltd has details of two machines that could fulfil the company's future production plans. Only one of these will be purchased.

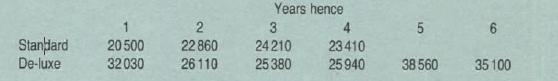

The ·standard' model costs £50000, and the 'de-luxe' £88000, payable immediately. Both machines would require the input of £10 000 working capital throughout their working lives. and both have no expected scrap value at the end of their expected working lives of 4 years for the standard machine and 6 years for the de-luxe machine.

The forecast pre-tax operating net cash flows (£) associated with the two mach1nes are

The de-luxe machine has only recently been introduced to the market, and has not been fully tested 1n operating conditions. Because of the higher risk mvolved, the appropriate d1scount rate for the de-luxe machine is believed to be 14% per year, 2% higher than the discount rate for the standard machine.

The company is proposing to finance the purchase of either machine wrth a term loan at a fixed interest rate of 11 % per year.

Taxation at 35% is payable on operating cash flows one year in arrears, and capital allowances are available at 25% per year on a reducing balance basis .

Required:

(a) For both the standard and the de-luxe machines calculate:

(i) payback period;

(ii) net present value.

Recommend, with reasons, which of the two machines Ceder Ltd should purchase.

(Relevant calculations must be shown.) (13 marks)

(b) If Ceder Ltd was offered the opportunity to lease the standard model mach1ne over a 4-year period at a rental of £15000 per year, not including maintenance costs, evaluate whether the company should lease or purchase the machine. (6 marks)

(c) Surveys have shown that the accounting rate of return and payback penod are widely used by companies in the capital investment decision process Suggest reasons for the widespread use of these mvestment appraisal techniques .

Step by Step Answer: