Cost allocation for all cost categories in the value chain, different costs for different purposes. (30-40 minutes)

Question:

Cost allocation for all cost categories in the value chain, different costs for different purposes. (30-40 minutes) Laser Tecnologia, Srl, develops, assembles and sells two product lines:

® Product Line A (laser scanning systems)

® Product Line B Caser cutting tools)

Product Line A is sold exclusively to the Italian Department of Defence under a cost-plus reimbursement contract. Product Line B is sold to commercial organisations.

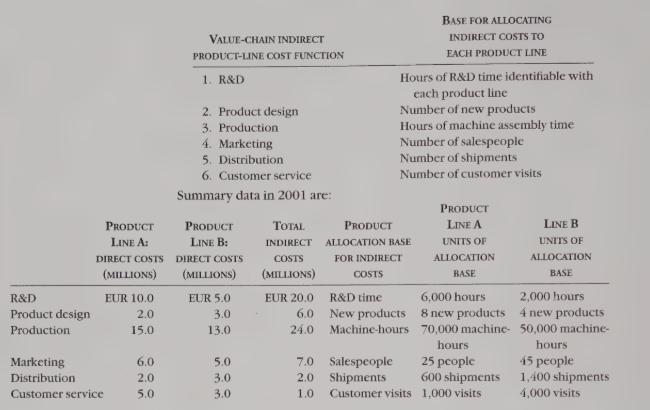

Laser Tecnologia classifies costs in each of its six value-chain business functions into two cost pools: direct product-line costs (separately traced to Product Line A or B) and indirect product-line costs. The indirect product-line costs are grouped into a single cost pool for each of the six functions of the value-chain cost structure:

REQUIRED 1. For product pricing on its Product Line B, Laser Tecnologia sets a preliminary selling price of 140% of full cost (made up of both direct costs and the allocated indirect costs for all six of the value-chain cost categories). What is the average full cost per unit of the 2,000 units of Product Line B produced in 2001?

For motivating managers, Laser Tecnologia separately classifies costs into three groups:

© Upstream (R&D and product design)

© Manufacturing © Downstream Gnarketing, distribution and customer service)

Calculate the costs (direct and indirect) in each of these three groups for Product Lines A and B.

For the purpose of income and asset measurement for reporting to external parties, inventoriable costs under generally accepted accounting principles for Laser Tecnologia include manufacturing costs and product design costs (both direct and indirect costs of each category). At the end of 2001, what is the average inventoriable cost for the 300 units of Product Line B on hand?

(Assume nil opening stock.)

The Department of Defence purchases all Product Line A units assembled by Laser Tecnologia. Laser is reimbursed 120% of allowable costs. Allowable cost is defined to include all direct and indirect costs in the R&D, product design, manufacturing, distribution and customer-service functions. Laser Tecnologia employs a marketing staff that makes many visits to government Officials, but the Department of Defence will not reimburse Laser for any marketing costs.

What is the 2001 allowable cost for Product Line A?

‘Differences in the costs appropriated for different decisions, such as pricing and cost reimbursement, are so great that firms should have multiple accounting systems rather than a single accounting system, Do you agree? kio45

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster