Divisional Profit PlanningWestern Company recently acquired Papion Men's Clothing Company which now operates as a western subsidiary.

Question:

Divisional Profit PlanningWestern Company recently acquired Papion Men's Clothing Company which now operates as a western subsidiary. Papion offers dress, casual, and sports clothing and related incidental accessories. The clothing is manufactured at several plants throughout the United States. The company's different lines are sold through company-owned stores and other retailers.

Western exercises close control over its subsidiaries. Western's management expects the subsidiaries' reports to present the proposed operating plans and to evaluate past performance in order to provide a foundation for this degree of control. However, Western's controller failed to provide Papion management with complete specifications regarding the format and the content of the reports because he had been devoting all of his energies to the final details of the acquisition.

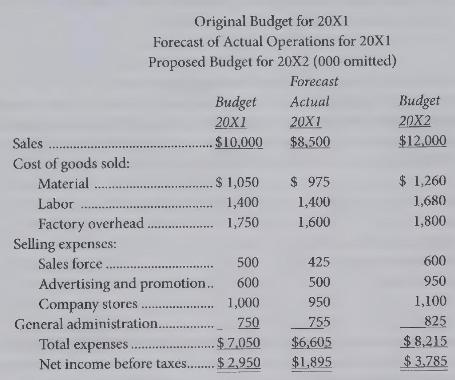

The Annual Operating Plan Report presented on the next page for Papion is the first report prepared and submitted to Western since the acquisition. Papion's management developed its own format for the report. The report includes the proposed budget for \(20 \times 2\) and related remarks regarding past and future operations.

(a) Would the proposed budget and accompanying remarks included in Papion Men's Clothing Company's Annual Operating Plan Report fulfill the needs of Western Company's management to exercise close control? Explain your answer.

(b) Irrespective of your answer to (a) what changes would you recommend in this report to improve its effectiveness for communicating the 20X2 plans of Papion Men's Clothing Company?

Papion Men's Clothing Company 20X2 Annual Operating Plan Report The Papion Men's Clothing Company expects the operating results for \(20 \mathrm{X} 2\) to be better than last year. Several actions have been taken which will improve sales and solve problems that affected operations last year. Sales should increase substantially due to the introduction of a new line of women's sportswear to be distributed through company-owned stores. Progress also was made last year in attracting other retailers to handle Papion's lines. Additional sales increases can be expected this year if negotiations to induce a major chain to distribute Papion lines are successful. The budget includes the sales expected to be made through this large chain retailer.

Operating costs should be lower this year. A new production facility should be completed in February to replace an older plant. This older plant has caused production shortages due to frequent equipment breakdowns. Also, labor problems which existed at the midwest plant have been resolved. Thus, the lower output and higher costs of the midwest plant should be corrected.

{Required:}

Prepared and submitted: October, \(20 \mathrm{X} 1\)

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline