During your examination of the financial statements of Benjamin Industries, the president requested your assistance in the

Question:

During your examination of the financial statements of Benjamin Industries, the president requested your assistance in the evaluation of several financial management problems in his home appliances division which he summarized for you as follows:

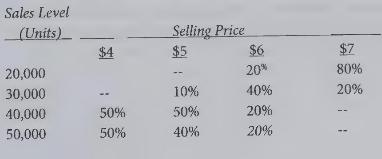

1. Management wants to determine the best sales price for a new appliance which has a variable cost of \(\$ 4\) per unit. The sales manager has estimated probabilities of achieving annual sales levels for various selling prices as shown in the following chart:

2. The division's current profit rate is \(5 \%\) on annual sales of \(\$ 1,200,000\); an investment of \(\$ 400,000\) is needed to finance these sales. The company's basis for measuring divisional success is return on investment.

3. Management is also considering the following two alternative plans submitted by employees for improving operations in the home appliances division:

Green believes that sales volume can be doubled by greater promotional effort, but his method would lower the profit rate to \(4 \%\) of sales and require an additional investment of \(\$ 100,000\).

Gold favors eliminating some unprofitable appliances and improving efficiency by adding \(\$ 200,000\) in capital equipment. His methods would decrease sales volume by \(10 \%\) but improve the profit rate to \(7 \%\).

{Required:}

(a) Prepare a schedule computing the expected incremental income for each of the sales prices proposed for the new product. The schedule should include the expected sales levels in units (weighted according to the sales manager's estimated probabilities), the expected total monetary sales, expected variable costs and the expected incremental income.

(b) Prepare schedules computing (1) the company's current rate of return on investment in the home appliances division, and the anticipated rates of return under the alternative suggestions made by (2) Green and (3) Gold.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline