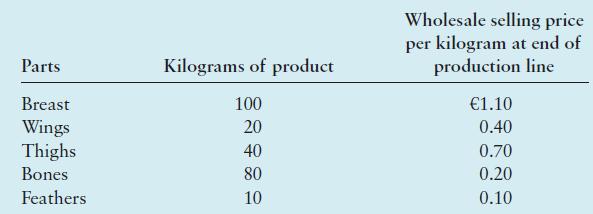

Galinha-Esquina SA grows and processes chickens. Each chicken is disassembled into five main parts. Information pertaining to

Question:

Galinha-Esquina SA grows and processes chickens. Each chicken is disassembled into five main parts. Information pertaining to production in July 2022 is as follows:

Joint costs of production in July 2022 were €100.

A special shipment of 20 kg of breasts and 10 kg of wings has been destroyed in a fire. Galinha-

Esquina’s insurance policy provides for reimbursement for the cost of the items destroyed. The insurance company permits Galinha-Esquina to use a joint-cost-allocation method. The split-off point is assumed to be at the end of the production line.

Required 1 Calculate the cost of the special shipment destroyed using

(a) the sales value at split-off point method, and

(b) the physical measure method using kilograms of finished product.

2 Which joint-cost-allocation method would you recommend that Galinha-Esquina use?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan