Intermediate: Calculation of cost-plus selling price and an evaluation of pricing decisions A firm manufactures two products

Question:

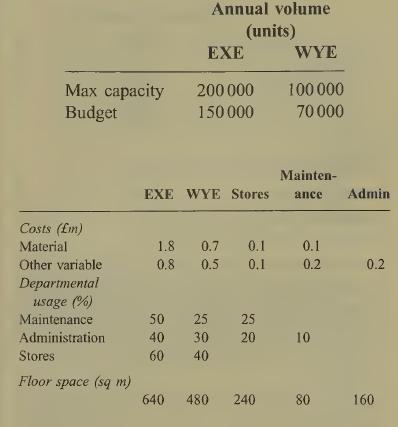

Intermediate: Calculation of cost-plus selling price and an evaluation of pricing decisions A firm manufactures two products EXE and WYE in departments dedicated exclusively to them. There are also three service departments, stores, maintenance and administration. No stocks are held as the products deteriorate rapidly.

Direct costs of the products, which are variable in the context of the whole business, are identified to each department. The step-wise apportionment of service department costs to the manufacturing departments is based on estimates of the usage of the service provided. These are expressed as percentages and assumed to be reliable over the current capacity range. The general factory over¬ heads of £3.6m, which are fixed, are apportioned based on floor space occupied. The company establishes product costs based on budgeted volume and marks up these costs by 25% in order to set target selling prices.

Extracts from the budgets for the forthcoming year are provided below:

Required:

Workings may be £000 with unit prices to the nearest penny.

(a) Calculate the budgeted selling price of one unit of EXE and WYE based on the usual mark up. (5 marks)

(b) Discuss how the company may respond to each of the following independent events, which represent additional business opportu¬ nities.

(i) an enquiry from an overseas customer for 3000 units only of WYE where a price of £35 per unit is offered (ii) an enquiry for 50 000 units of WYE to be supplied in full at regular intervals during the forthcoming year at a price which is equivalent to full cost plus 10%

In both cases support your discussion with calculations and comment on any assumptions or matters on which you would seek clarifica¬ tion. (11 marks)

(c) Explain the implications of preparing product full costs based on maximum capacity rather than annual budget volume. (4 marks)

(Total 20 marks) ACCA Paper 8 Managerial FinanceLO1

Step by Step Answer: