Intermediate: Calculation of minimum purchase cost when cost per unit is not constant A company is reviewing

Question:

Intermediate: Calculation of minimum purchase cost when cost per unit is not constant A company is reviewing the purchasing policy for one of its raw materials as a result of a reduction in production requirement. The material, which is used evenly throughout the year, is used in only one of the company’s products, the production of which is currently 12 000 units per annum. Each finished unit of the product contains 0.4 kg of the material. 20% of the material is lost in the produc¬ tion process. Purchases can be made in multiples of 500 kg, with a minimum purchase order quantity of 1000 kg.

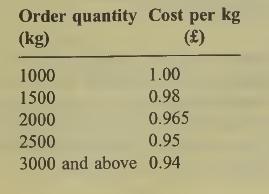

The cost of the raw material depends upon the purchase order quantity as follows:

Costs of placing and handling each order are £90, of which £40 is an apportionment of costs which are not expected to be affected in the short term by the number of orders placed. Annual holding costs of stock are £0.90 per unit of average stock, of which only £0.40 is expected to be affected in the short term by the amount of stock held.

The lead time for the raw materials is one month, and a safety stock of 250 kg is required.

Required:

(a) Explain, and illustrate from the situation described above, the meaning of the terms ‘variable’, ‘semivariable’ and ‘fixed’ costs.

(8 marks)

(b) Calculate the annual cost of pursuing alter¬

native purchase order policies and thus advise the company regarding the purchase order quantity for the material that will minimize cost. (14 marks)

(Total 22 marks) ACCA Level 1 Costing 25.12Advanced: Evaluation of an increase in order size incorporating quantity discounts Whirlygig pic manufactures and markets automatic dishwashing machines. Among the components which it purchases each year from external sup¬ pliers for assembly into the finished article are window units, of which it uses 20000 units per annum.

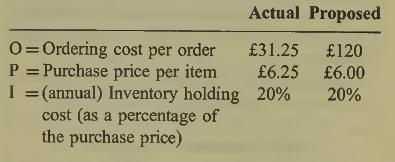

It is considering buying in larger amounts in order to claim quantity discounts. This will lower the number of orders placed but raise the adminis¬ trative and other costs of placing and receiving orders. Details of actual and expected ordering and carrying costs are given in the table below:

To implement the new arrangements will require reorganisation costs estimated at £10000 which can be wholly claimed as a business expense for tax purposes in the tax year before the system comes into operation. The rate of corporate tax is 33%, payable with a one-year delay.

Required:

(a) Determine the change in the economic order quantity (EOQ) caused by the new system.

(4 marks)

(b) Calculate the payback period for the proposal and comment on your results. (10 marks)

(c) Briefly discuss the suitability of the payback method for evaluating investments of this nature. (6 marks)

(Total 20 marks) ACCA Paper 8 Managerial Finance

Step by Step Answer: