Intermediate: Decision-making and CVP analysis (a) The current average weekly trading results of the Swish Restaurant in

Question:

Intermediate: Decision-making and CVP analysis

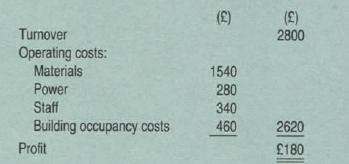

(a) The current average weekly trading results of the Swish Restaurant in Sumtown are shown below:

The average selling price of each meal is £4; materials and power may be regarded as a variable cost varying with the number of meals prov1ded. Staff costs are semi-variable with a fixed cost element of £200 per week; the building occupany costs are all fixed Required:

Calculate the number of meals requ1red to be sold in order to earn a profit of £300 per week. (3 marks)

(b) The owners of the restaurant are considering expanding their business and using under-utilized space by diversifying into:

either (1) take-away foods, or (2) high quality meals.

The sales estimate for both proposals is rather uncertain and it is recognized that actual sales volume could be up to 20% either higher or lower than that estimated.

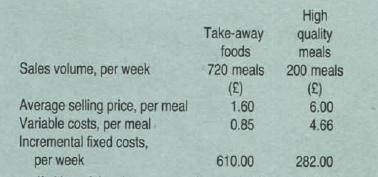

The estimated sales and costs of each proposal are:

If either of the above proposals were implemented it has been estimated that the existing restaurant's operations would be affected as follows:

(i) As a result of bulk purchasing, material costs incurred would be reduced by 10p per meal. This saving would apply to all meals produced in the existing restaurant.

(ii) Because more people would be aware of the existence of the restaurant it is estimated that turnover would increase. If the 'take-away food'

section were opened then for every ten take-away meals sold the existing restaurant's sales would increase by one meal, alternatively if the 'high quality meals' section were open then for every five such meals sold the existing restaurant's sales would increase by one meal.

A specific effect of implementing the 'take-away food'

proposal would be a change in the terms of employment of the staff in the existing restaurant, the result of which would be that the staff wage of £340 per week would have to be regarded as a fixed cost.

Required:

Calculate, for each of the proposed methods of diversification:

(i) The additional profit which would be earned by the owners of the restaurant if the estimated sales were achieved. (8 marks)

(ii) The sales volume at which the owners of the restaurant would earn no additional profit from the proposed diversification. (5 marks)

(c) Carefully consider the conclusions which may be drawn from your calculations in

(b) above.

Utile variation is expected in the inventories of raw materials, work in progress, or finished goods during the quarter. You have been retained as a consultant to advise Stoic's board on its policies relating to pricing and production.

You are required to determine as accurately as possible the effect on Stoic's financial performance of each in turn of the following five independent proposals (i.e. assuming that everything not specified in the particular proposal remains the same):

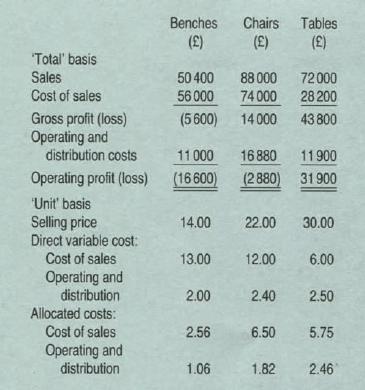

(i) the product line Benches is discontinued; (2 marks)

(ii) the product line Benches is discontinued with a consequential decrease of 400 units in the sales of product line Tables; (3 marks)

(iii) the selling price of product line Benches is increased to £16.00 per unit, with a consequential decrease of one-sixth in the number of Benches sold; (3 marks)

(iv) the product tine Benches is discontinued, and the plant used to make a replacement new product line, Garden Gnomes. Expected sales of Garden Gnomes would be 3200 sets at a price of £19.00 per set. The variable cost of sales would be £12.00 per set, and the variable operating and distribution costs would be £4.10 per set. The total overhead and indirect costs previously allocated to product line Benches would be allocated to product line Garden Gnomes; (3 marks)

(v) part of the plant in which the product line Benches is made is adapted to make product line Chairs. The output and sales of Chairs would be increased to 5000 units (each sold at a unit price of £21.00), and the output and sales of Benches reduced to 2400 units (each sold at a unit price of £17.00). (4 marks)

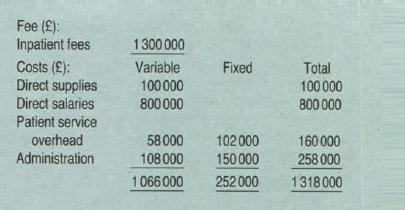

(b) The Epicure Nursing Home budgets are as follows for 1980

You are required to calculate:

(i) the contribution margin ratio; (2 marks)

(ii) the break-even point in both inpatient days and inpatient fees; (2 marks)

(iii) the margin of safety ratio (to two places of decimals)

if the home operates at full capacity; (2 marks)

(iv) the break-even point in inpatient days if direct salaries were increased to £826000, making total variable costs £1 092000, all matters not specified remaining the same; (2 marks)

(v) the break-even point in inpatient days if fixed patient service overheads were increased to £120000, making total fixed costs £270000, all other matters remaining the same

Step by Step Answer: