Intermediate: Deleting a segment A company manufactures and sells a wide range of products. The products are

Question:

Intermediate: Deleting a segment A company manufactures and sells a wide range of products. The products are manufactured in various locations and sold in a number of quite separate markets. The company’s operations are organised into five divisions which may supply each other as well as selling on the open market.

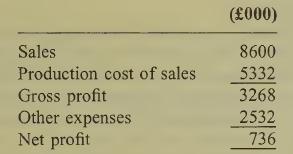

The following financial information is available concerning the company for the year just ended:

An offer to purchase Division 5, which has been performing poorly, has been received by the company.

The gross profit percentage of sales, earned by Division 5 in the year, was half that earned by the company as a whole. Division 5 sales were 10% of total company sales. Of the production expenses incurred by Division 5, fixed costs were £316 000. Other expenses (i.e. other than production expenses) incurred by the division totalled £156 000, all of which can be regarded as fixed. These include £38 000 apportionment of general company expenses which would not be affected by the decision concerning the possible sale of Divi¬ sion 5.

In the year ahead, if Division 5 is not sold, fixed costs of the division would be expected to increase by 5% and variable costs to remain at the same percentage of sales. Sales would be expected to increase by 10%.

If the division is sold, it is expected that some sales of other divisions would be lost. These would provide a contribution to profits of £20 000 in the year ahead. Also, if the division is sold, the capital sum received could be invested so as to yield a return of £75 000 in the year ahead.

Required:

(a) Calculate whether it would be in the best interests of the company, based upon the expected situation in the year ahead, to sell Division 5. (13 marks)

(b) Discuss other factors that you feel should influence the decision. (7 marks)

(c) Calculate the percentage increase in Division 5 sales required in the year ahead (compared with the current year) for the financial viab¬ ility of the two alternatives to be the same. (You are to assume that all other factors in the above situation will remain as forecast for the year ahead.)

Step by Step Answer: