Intermediate: Non-graphical CVP analysis M Ltd manufactures one standard product, the standard marginal cost of which is

Question:

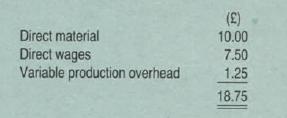

Intermediate: Non-graphical CVP analysis M Ltd manufactures one standard product, the standard marginal cost of which is as follows:

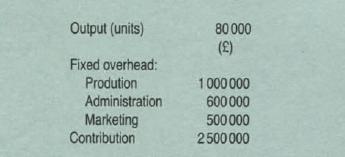

The budget for the year includes the following:

Management, in considering this budget for the coming year, is dissatisfied with the results likely to arise. A board meeting held recently discussed possible strategies to improve the situation and the following ideas were proposed:

(1) The production director suggested that the selling price of the product should be reduced by 10%. This, he feels, could increase the output and sales by 25%. It is estimated that fixed production overhead would increase by £50 000 and fixed marketing overhead by £25 000.

(2) The finance director suggested that the selling price should be increased by 10%. It is estimated that if the current advertising expenditure of £100000 were to be increased by £400000, sales could be increased to 90000 units. Fixed production overhead would increase by £25 000 and marketing overhead by £20000.

(3) The managing director seeks a profit of £600 000. He asks what selling price is required to achieve this if it is estimated that:

an increase in advertising expenditure of £360 000 would result in a 10% increase in sales, and fixed production overhead would increase by £25000 and marketing overhead by £17 000.

(4) The marketing director suggested that with an appropriate increase in advertising expenditure sales could be increased by 20% and a profit on turnover of 15% obtained. It is estimated that in this circumstance fixed production overhead would increase by £40000 and marketing overhead by £25 000. What additional expendrture on advertising would be made to achieve these results?

(5) The chairman has received an approach from a department store to supply on a long-term contract 20 000 units per annum at a special discount. Existing sales would not be affected and fixed production overhead would be increased by £50 000 per annum. How much special discount could be given if by accepting the contract the profit of the company were to be increased to £675 000 per annum?

You are required to compile a forecast profit statement for the year for each of the proposals given and comment briefly on each.

Step by Step Answer: