Intermediate: Preparation of cash budgets and calculation of stock, debtor and creditor balances In the near future

Question:

Intermediate: Preparation of cash budgets and calculation of stock, debtor and creditor balances In the near future a company will purchase a manufacturing business for £315 000, this price to include goodwill (£150000), equipment and fittings (£120000), and stock of raw materials and finished goods (£45 000). A delivery van will be purchased for £15 000 as soon as the business purchase is completed. The delivery van will be paid for in the second month of operations.

The following forecasts have been made for the business following purchase:

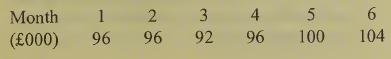

(i)Sales (before discounts) of the business’s single product, at a mark-up of 60% on production cost, will be:

25% of sales will be for cash; the remainder will be on credit, for settlement in the month following that of sale. A discount of 10% will be given to selected credit customers, who represent 25% of gross sales.

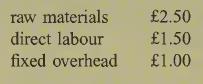

(ii) Production cost will be £5.00 per unit. The production cost will be made up of:

(iii) Production will be arranged so that closing stock at the end of any month is sufficient to meet sales requirements in the following month. A value of £30 000 is placed on the stock of finished goods which was acquired on purchase of the business. This valuation is based on the forecast of production cost per unit given in (ii) above.

(iv) The single raw material will be purchased so that stock at the end of a month is sufficient to meet half of the following month’s production requirements. Raw material stock acquired on purchase of the business (£15 000) is valued at the cost per unit which is forecast as given in (ii) above. Raw materials will be purchased on one month’s credit.

(v) Costs of direct labour will be met as they are incurred in production.

(vi) The fixed production overhead rate of £1.00 per unit is based upon a forecast of the first year’s production of 150000 units. This rate includes depreciation of equipment and fittings on a straight-line basis over the next five years.

(vii) Selling and administration overheads are all fixed, and will be £208 000 in the first year. These overheads include depreciation of the delivery van at 30% per annum on a reducing balance basis. All fixed overheads will be incurred on a regular basis, with the exception of rent and rates. £25 000 is payable for the year ahead in month one for rent and rates.

Required:

(a) Prepare a monthly cash budget. You should include the business purchase and the first four months of operations following purchase.

(17 marks)

(b) Calculate the stock, debtor, and creditor balances at the end of the four month period. Comment briefly upon the liquidity situation.

Step by Step Answer: