Intermediate: Preparation of cash budgets The management of Beck pic have been informed that the union representing

Question:

Intermediate: Preparation of cash budgets The management of Beck pic have been informed that the union representing the direct production workers at one of their factories, where a standard product is produced, intends to call a strike. The accountant has been asked to advise the manage¬ ment of the effect the strike will have on cash flow. The following data has been made available:

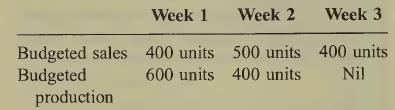

The strike will commence at the beginning ofweek 3 and it should be assumed that it will continue for at least four weeks. Sales at 400 units per week will continue to be made during the period of the strike until stocks of finished goods are exhausted. Production will stop at the end of week 2. The current stock level of finished goods is 600 units. Stocks of work in progress are not carried.

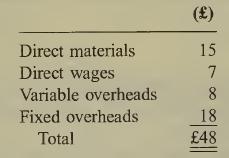

The selling price of the product is £60 and the budgeted manufacturing cost is made up as follows:

Direct wages are regarded as a variable cost. The company operates a full absorption costing system and the fixed overhead absorption rate is based upon a budgeted fixed overhead of £9000 per week. Included in the total fixed overheads is £700 per week for depreciation of equipment. During the period of the strike direct wages and variable overheads would not be incurred and the cash expended on fixed overheads would be reduced by £1500 per week.

The current stock of raw materials are worth £7500; it is intended that these stocks should increase to £11000 by the end of week 1 and then remain at this level during the period of the strike. All direct materials are paid for one week after they have been received. Direct wages are paid one week in arrears. It should be assumed that all relevant overheads are paid for immedi¬ ately the expense is incurred. All sales are on credit, 70% of the sales value is received in cash from the debtors at the end of the first week after the sales have been made and the balance at the end of the second week.

The current amount outstanding to material suppliers is £8000 and direct wage accruals amount to £3200. Both of these will be paid in week 1. The current balance owing from debtors is £31 200, of which £24 000 will be received during week 1 and the remainder during week 2. The current balance of cash at bank and in hand is £1000.

Required:

(a) (i) Prepare a cash budget for weeks 1 to 6 showing the balance of cash at the end of each week together with a suitable analysis of the receipts and payments during each week. (13 marks)

(ii) Comment upon any matters arising from the cash budget which you consider should be brought to management’s attention. (4 marks)

(b) Explain why the reported profit figure for a period does not normally represent the amount of cash generated in that period.

(5 marks) (Total 22 marks) ACCA Level 1 Costing

Step by Step Answer: