Intermediate: Preparation of process accounts and apportionment of joint costs A company manufactures two types of industrial

Question:

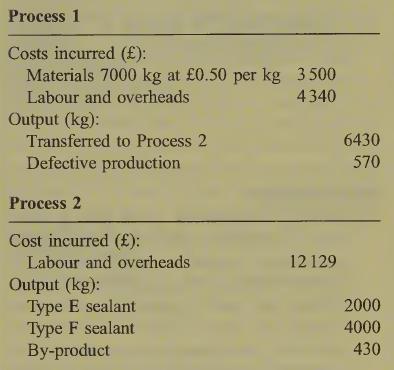

Intermediate: Preparation of process accounts and apportionment of joint costs A company manufactures two types of industrial sealant by passing materials through two consecu¬ tive processes. The results of operating the two processes during the previous month are shown below:

It is considered normal for 10% of the total output from process 1 to be defective and all defective output is sold as scrap at £0.40 kg. Losses are not expected in process 2.

There was no work in process at the beginning or end of the month and no opening stocks of sealants.

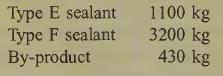

Sales of the month’s output from Process 2 were:

The remainder of the output from Process 2 was in stock at the end of the month.

The selling prices of the products are: Type E sealant £7 per kg and Type F sealant £2.50 per kg. No additional costs are incurred on either of the two main products after the second process. The by-product is sold for £1.80 per kg after being sterilized, at a cost of £0.30 per kg, in a subsequent process. The operating costs of process 2 are reduced by the net income receivable from sales of the by-product.

Required:

(a) Calculate, for the previous month, the cost of the output transferred from process 1 into process 2 and the net cost or saving arising . from any abnormal losses or gains in pro¬ cess 1. (6 marks)

(b) Calculate the value of the closing stock of each sealant and the profit earned by each sealant during the previous month using the following methods of apportioning costs to joint products:

(i) according to weight of output, (ii) according to market value of output.

(12 marks)

(c) Consider whether apportioning process costs to joint products is useful. Briefly illustrate with examples from your answer to

(b) above.

Step by Step Answer: