Nyborg Supermarkets AS is preparing its activity-based budget for January 2018 for its operating costs (that is,

Question:

Nyborg Supermarkets AS is preparing its activity-based budget for January 2018 for its operating costs (that is, its non-cost of goods purchased for resale costs). Its current concern is with its four activity areas (which are also indirect-cost categories in its product profitability reporting system):

a. Ordering – covers purchasing activities. The cost driver is the number of purchase orders

b. Delivery – covers the physical delivery and receipt of merchandise. The cost driver is the number of deliveries

c. Shelf-stacking – covers the stacking of merchandise on store shelves and the ongoing restacking before sale

d. Customer support – covers assistance provided to customers, including check-out and bagging.

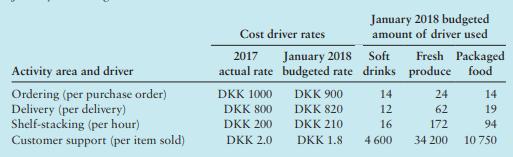

Assume Nyborg Supermarkets has only three product areas: soft drinks, fresh produce and packaged food. The budgeted usage of each cost driver in these three areas of the store and the January 2018 budgeted cost driver rates are as follows:

Required

1. What is the total budgeted cost for each activity area in January 2018?

2. What advantages might Nyborg Supermarkets gain by using an activity-based budgeting approach over (say) an approach for budgeting operating costs based on a budgeted percentage of cost of goods sold times the budgeted cost of goods sold?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan