Pertinent transfer price. (20-30 minutes) Liberaki, SA, has two divisions, A and B, which manufacture bicycles. Division

Question:

Pertinent transfer price. (20-30 minutes) Liberaki, SA, has two divisions, A and B, which manufacture bicycles. Division A produces the bicycle frame, and Division B assembles the rest of the bicycle onto the frame. There is a market for both the subassembly and the final product.

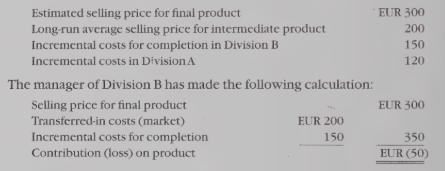

Each division has been designated as a profit centre. The transfer price for the subassembly has been set at the long-run average market price. The following data are available to each division:

REQUIRED 1. Should transfers be made to Division B if there is no excess capacity in Division A? Is the market price the correct transfer price?

Assume that Division A’s maximum capacity for this product is 1,000 units per month and sales to the intermediate market are now 800 units. Should 200 units be transferred to Division B? At what transfer price? Assume that for a variety of reasons, A will maintain the EUR 200 selling price indefinitely; that is, A is not considering lowering the price to outsiders even if idle capacity exists.

Suppose Division A quoted a transfer price of EUR 150 for up to 200 units.

What would be the contribution to the company as a whole if the transfer were made? As manager of Division B, would you be inclined to buy at EUR 150?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster