Purchase, Lease, or Build Equipment The Edwards Corporation is considering adding a new stapler to one of

Question:

Purchase, Lease, or Build Equipment The Edwards Corporation is considering adding a new stapler to one of its product lines. More equipment will be required to produce the new stapler. There are three alternative ways to acquire the needed equipment: (1) purchase general purpose equipment, (2) lease general purpose equipment, (3) build special purpose equipment. A fourth alternative, purchase of the special purpose equipment, has been ruled out because it would be prohibitively expensive.

The general purpose equipment can be purchased for \(\$ 125,000\). The equipment has an estimated salvage of \(\$ 15,000\) at the end of its useful life of ten years. At the end of five years the equipment can be used elsewhere in the plant or be sold for \(\$ 40,000\).

Alternatively, the general purpose equipment can be acquired by a five year lease for \(\$ 40,000\) annual rent. The lessor will assume all responsibility for taxes, insurance and maintenance.

Special purpose equipment can be constructed by the contract equipment department of the Edwards Corporation. While the department is operating at a level which is normal for the time of year, it is below full capacity. The department could produce the equipment without interfering with its regular revenue producing activities.

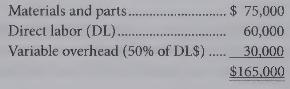

The estimated departmental costs for the construction of the special purpose equip

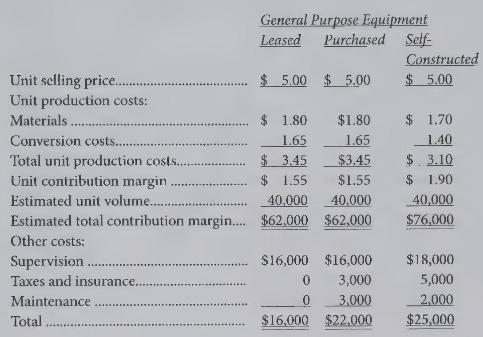

However, the cost of the equipment for depreciation purposes is \(\$ 180,000\), a full cost basis. This full cost includes \(\$ 15,000\) of fixed overhead which would be incurred regardless of whether or not the equipment was constructed. Engineering and management studies provide the following revenue and cost estimates (excluding lease payments and depreciation) for producing the new stapler, depending upon the equipment used:

The company will depreciate the general purpose machine over ten years on the sum-of-the-years'-digits (S-Y-D) method. At the end of five years the accumulated depreciation will total \(\$ 80,000\). (The present value of this amount for the first five years is \(\$ 62,100)\). The special purpose machine will be depreciated over five years on the S-Y-D method. Its salvage value at the end of that time is estimated to be \(\$ 30,000\). The company uses an after tax cost of capital of 10 percent. Its marginal tax rate is 40 percent.

{Required:}

Calculate which of the three options would be the best using the net present value method.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline