Question from the Chartered Association of Certified Accountants, Professional Stage Module E, December 1995. (60 minutes) A

Question:

Question from the Chartered Association of Certified Accountants, Professional Stage Module E, December 1995. (60 minutes)

A company is considering the improvement of the lighting system in one of its offices. The following information is available:

The building will be sold in three years’ time. It is proposed that the existing lighting be replaced by either large or small ‘task-focused’

lighting units at a cost of £750 per unit for small units and 41,250 per unit for large units. The total requirement will be for 80 small units or 50 large units. All purchases will be paid for immediately (year 0).

The quantity of electricity used will be reduced from that of the existing lighting system by 40% if small units are introduced, and by 30% if large units are introduced. The electricity cost allocated to the office in the year prior to purchase (year 0) is £50,000 for the existing lighting system. This includes a £10,000 share of standing charges paid by the company and the balance at a constant cost per unit of electricity used.

The existing lighting system has maintenance costs of £12,000 per annum in the year prior to purchase (year 0). This includes a £5,000 share of the salary of an electrician who will be retained by the company whether or not he undertakes this work. The balance is for spare parts. Most of the spare parts are purchased as required but

£1,000 worth per annum are taken from stock purchased some time ago. The spare parts stock is sufficient to last for a further two years

(at &1,000 per annum). Such spare parts would currently (year 0)

cost 30% more to purchase than the original purchase price. Existing stock could not be sold or used elsewhere if not used for lighting maintenance.

The new lighting system (large or small units) will have maintenance costs of £5,000 in year 1 (at year 1 prices) which will include a £3,000 share of the salary of the electrician currently used for lighting maintenance. The remaining cost is for spare parts which will be specially purchased. The quantity of spare parts required will increase by 25%

in year 2 and by a further 10% of the year 2 level in year 3.

It is estimated that the task-focused lighting (large or small units) will increase the saleable value of the building by £15,000 at the end of year 3 with the cash flow relating to the sale taking place at the end of year 4.

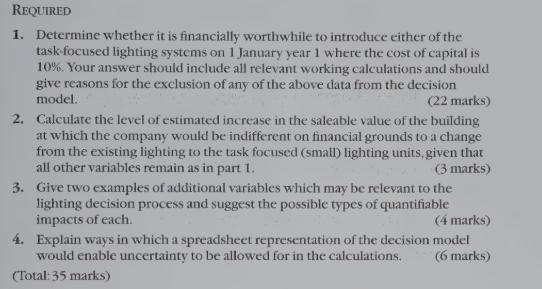

vi. It is estimated that all costs will increase because of price level changes according to the following index table (all indices expressed in terms of a year 0 index of 100): 157

![]()

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster