Question from the Institute of Chartered Accountants in Ireland, Professional Examination 3, Management Accounting & Business Finance

Question:

Question from the Institute of Chartered Accountants in Ireland, Professional Examination 3, Management Accounting & Business Finance II, Summer 1995. (40 minutes)

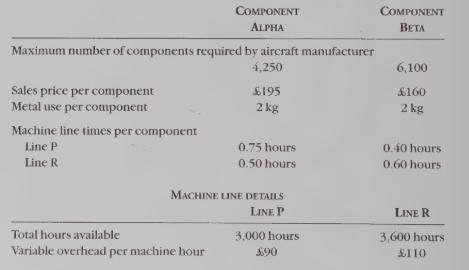

Combustion Ltd supplies components to a major aircraft manufacturer. A new aircraft is now being produced and Combustion Ltd can supply either component Alpha or component Beta. However, it does not have the production capacity to supply both.

Both components are made from the same metal, of which there is only 10,000 kg available at £10 per kg. Both components must pass through two high-technology machine lines—Line P and Line R—each of which has capacity limitations.

Sales prices have been set and the following data are available for Budget Period 1 of 1995: mkli58

REQUIRED

(a) Calculate which component should be manufactured by Combustion Ltd to maximise contribution. (8 marks)

(b) Calculate the contribution which Combustion Ltd will earn and, based on

(a) above, whether the company will be capable of meeting the maximum Capacity required for either of the two components. (4 marks)

(c) The aircraft manufacturer has offered an alternative pricing structure per component as follows: Sales price less 10% per component plus £60 per hour for each hour any of the production lines are unused.

Indicate how this alternative pricing arrangement might affect your choice, in

(a) above, of component to be manufactured and, if it does affect your choice, calculate the new contribution. (8 marks)

Total marks = 20 N.B. Linear programming is not required.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster