Refer to Exercise 18.19. Data From Exercise 18.19 Liberaki SA has two divisions, A and B, which

Question:

Refer to Exercise 18.19.

Data From Exercise 18.19

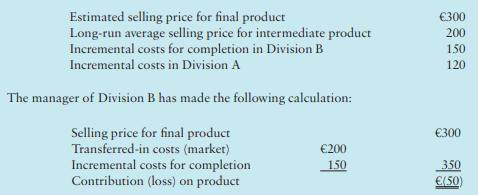

Liberaki SA has two divisions, A and B, which manufacture bicycles. Division A produces the bicycle frame, and Division B assembles the bicycle components onto the frame. There is a market for both the subassembly and the final product. Each division has been designated as a profit centre. The transfer price for the subassembly has been set at the long-run average market price. The following data are available to each division:

Required

1. Suppose the manager of Division A has the option of (a) cutting the external price to €195 with the certainty that sales will rise to 1000 units, or (b) maintaining the outside price of €200 for the 800 units and transferring the 200 units to Division B at some price that would produce the same operating profit for Division A. What transfer price would produce the same operating profit for Division A? Does that price coincide with that produced by the general guideline in the chapter so that the desirable decision for the company as a whole would result?

2. Suppose that if the selling price for the intermediate product is dropped to €195, outside sales can be increased to 900 units. Division B wants to acquire as many as 200 units if the transfer price is acceptable. For simplicity, assume that there is no outside market for the final 100 units of Division A’s capacity.

a. Using the general guideline, what is (are) the minimum transfer price(s) that should lead to the correct economic decision? Ignore performance-evaluation considerations.

b. Compare the total contributions under the alternatives to show why the transfer price(s) recommended lead(s) to the optimal economic decision.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan