Relevant costs, replacement decisions performance evaluation. (30 minutes) Kjell Svensson, the general manager of Hoglund, AB, is

Question:

Relevant costs, replacement decisions performance evaluation.

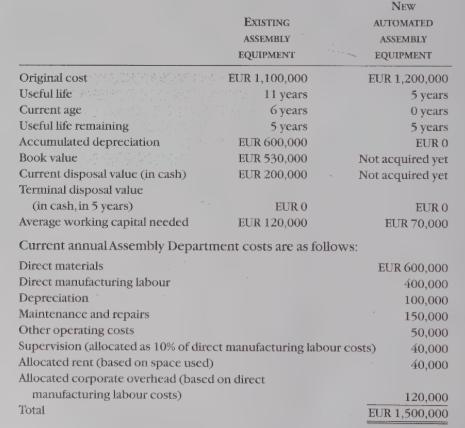

(30 minutes) Kjell Svensson, the general manager of Hoglund, AB, is contemplating replacing the existing assembly-line equipment in the Assembly Department with automated assembly equipment. Production output and revenues will be unaffected by the replacement decision.

Transactions related to the capital investment are cash transactions that would occur today. bht7

a. Hoglund uses straight-line depreciation calculated on the difference between the initial equipment investment and the terminal disposal value of the equipment.

b. The new equipment will produce output more swiftly. Therefore, the average working-capital investment, if the new equipment is purchased, will decrease.

c. Of the total direct materials costs, EUR 120,000 is waste and scrap.

The new equipment is expected to reduce scrap costs to EUR 20,000.

d. The new equipment is expected to reduce direct manufacturing labour costs by EUR 150,000 each year.

e. Maintenance and repairs on the old equipment have been excessive.

If the new equipment is acquired, maintenance and repair costs are expected to decrease to EUR 100,000.

f. H6glund collects all supervision costs for all manufacturing departments in the plant into one cost pool. These costs are then allocated to departments on the basis of direct manufacturing labour costs. The Assembly Department has only one supervisor currently. The supervisor will continue in her current position if the new equipment is purchased.

g. The new equipment will reduce the space required for assembly operations by 20%, reducing allocated rent by EUR 8,000. Hogiund has no alternative uses for this extra space.

h. Corporate overhead costs are allocated to each department at 30% of direct manufacturing labour costs of each department.

Svensson estimates a required rate of return of 12% for this project.

REQUIRED i3 On the basis of the net present-value method, should Svensson replace the existing assembly equipment?

Suppose that next year is the last year Hoglund will offer the attractive bonus plan currently in place. Svensson’s bonus hinges on short-run accounting income for that year. Will Svensson be inclined to replace the Assembly Department equipment? Provide quantitative support for your answer.

What non-financial and qualitative factors should Svensson consider in coming to a decision?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster