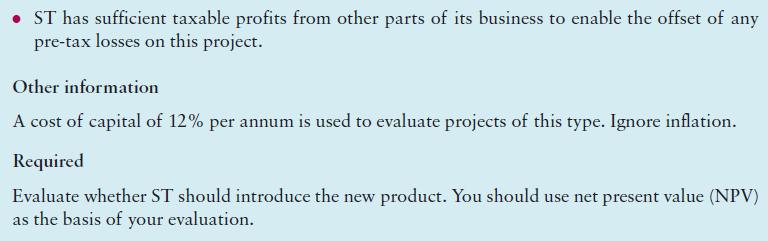

ST operates in a highly competitive market and is considering introducing a new product to expand its

Question:

ST operates in a highly competitive market and is considering introducing a new product to expand its current range. The new product will require the purchase of a specialised machine costing £825 000. The machine has a useful life of four years and is expected to have a scrap value at the end of Year 4 of £45 000. The company uses the straight line method of depreciation. The machine would be used exclusively for the new product.

Due to a shortage of space in the factory, investment in the new machine would necessitate the disposal, for £23 000, of an existing machine which has a net book value of £34 000. This machine, if retained for a further year, would have earned a contribution of £90 000 before being scrapped for nil value. The machine had a zero tax written-down value and therefore there will be no effect on tax depreciation arising from the disposal of the machine.

The company employed the services of a consultant, at a cost of £29 000, to determine the demand for the new product. The consultant’s estimated demand is given below:

The new product is expected to earn a contribution of £30 per unit.

Fixed costs of £380 000 per annum, including depreciation of the new machine, will arise as a direct result of the manufacture of the new product.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan