Question:

Starkuchen GmbH has been in the food-processing business for three years. For its first two years

(2021 and 2022), its sole product was raisin cake. All cakes were manufactured and packaged in 1 kg units. A normal costing system was used by Starkuchen. The two direct-cost categories were direct materials and direct manufacturing labour. The sole indirect manufacturing cost category –

manufacturing overhead – was allocated to products using a units of production allocation base.

In its third year (2023) Starkuchen added a second product – layered carrot cake – that was packaged in 1 kg units. This product differs from raisin cake in several ways:

Transcribed Image Text:

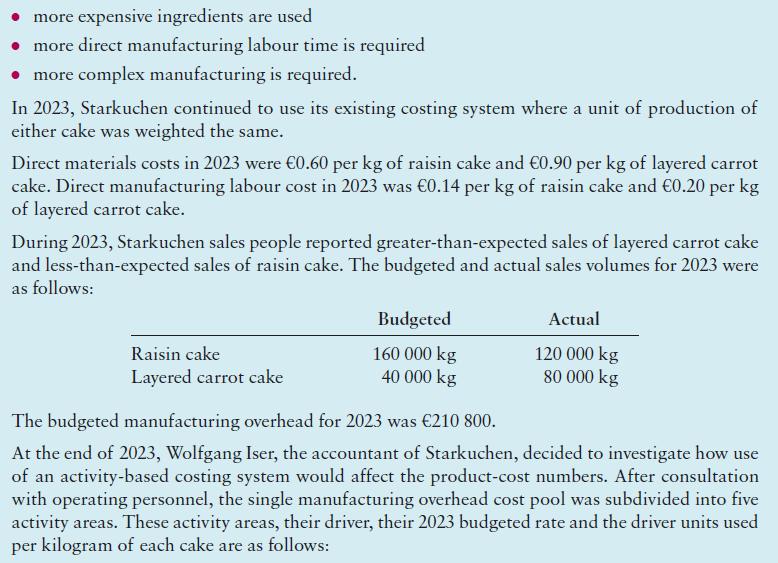

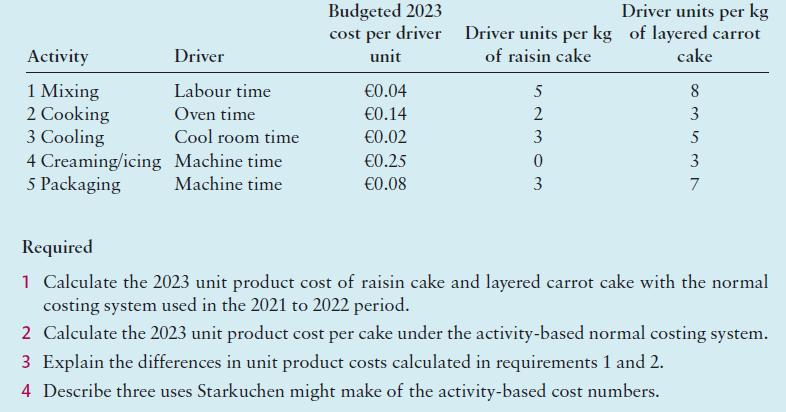

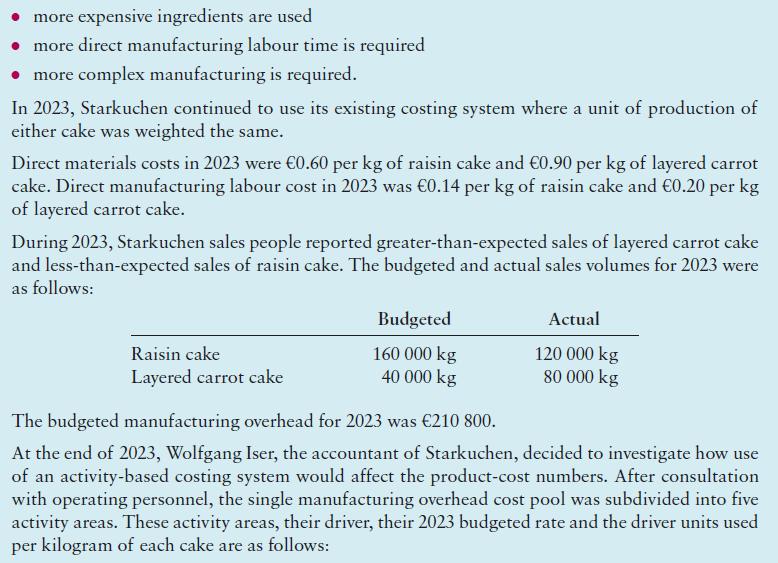

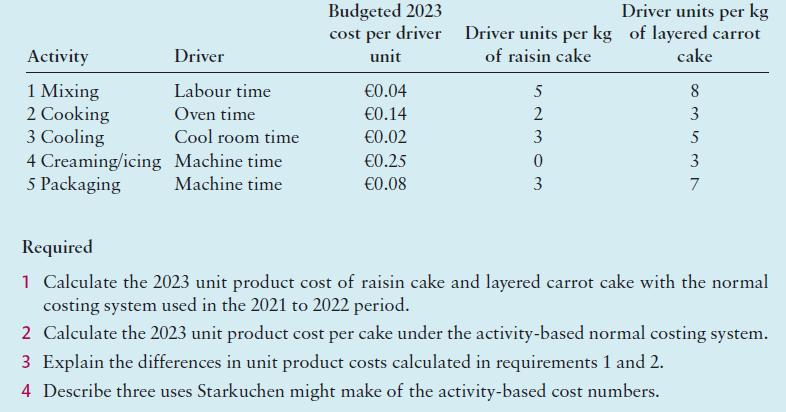

more expensive ingredients are used more direct manufacturing labour time is required more complex manufacturing is required. In 2023, Starkuchen continued to use its existing costing system where a unit of production of either cake was weighted the same. Direct materials costs in 2023 were 0.60 per kg of raisin cake and 0.90 per kg of layered carrot cake. Direct manufacturing labour cost in 2023 was 0.14 per kg of raisin cake and 0.20 per kg of layered carrot cake. During 2023, Starkuchen sales people reported greater-than-expected sales of layered carrot cake and less-than-expected sales of raisin cake. The budgeted and actual sales volumes for 2023 were as follows: Raisin cake Layered carrot cake Budgeted Actual 160 000 kg 40 000 kg 120 000 kg 80 000 kg The budgeted manufacturing overhead for 2023 was 210 800. At the end of 2023, Wolfgang Iser, the accountant of Starkuchen, decided to investigate how use of an activity-based costing system would affect the product-cost numbers. After consultation with operating personnel, the single manufacturing overhead cost pool was subdivided into five activity areas. These activity areas, their driver, their 2023 budgeted rate and the driver units used per kilogram of each cake are as follows: