T Ltd is a newly-formed company that designs customised computer programs for its clients. The capital needed

Question:

T Ltd is a newly-formed company that designs customised computer programs for its clients. The capital needed to fund the company will be provided by a venture capitalist who will invest

£150,000 on 1 January 2002 in exchange for shares in T Ltd.

The Directors are currently gathering the information needed to help in the preparation of the cash budget for the first three months of 2002. The information that they have is given below.

Budget details The budgeted sales (that is, the value of the contracts signed) for the first quarter of 2002 are expected to be £200,000. However, as the company will only just have commenced trading, it is thought that sales will need time to grow. It is therefore expected that 15% of the first quarter's sales will be achieved in January, 30% in February and the remainder in March. It is expected that sales for the year ending 31 December 2002 will reach £1,000,000.

Clients must pay a deposit of 5% of the value of the computer program when they sign the contract for the program to be designed. Payments of 45% and 50% of the value are then paid one and two months later respectively. No bad debts are anticipated in the first quarter.

There are six people employed by the company, each earning an annual gross salary of £45,000, payable in arrears on the last day of each month.

Computer hardware and software will be purchased for £100,000 in January. A deposit of 25% is payable on placing the order for the computer hardware and software, with the remaining balance being paid in equal amounts in February and March. The capital outlay will be depreciated on a straight-line basis over three years, assuming no residual value.

The company has decided to rent offices that will require an initial deposit of £13,000 and an ongoing cost of £6,500 per month payable in advance. These offices are fully serviced and the rent is inclusive of all fixed overhead costs.

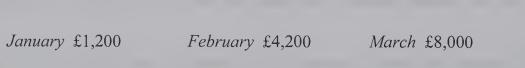

Variable production costs are paid in the month in which they are incurred and are budgeted as follows

A marketing and advertising campaign will be launched in January at a cost of £10,000 with a further campaign in March for £5,000, both amounts being payable as they are incurred.

Administration overhead is budgeted to be £500 each month; 60% to be paid in the month of usage and the balance one month later.

Tax and interest charges can be ignored.

Required:

(a) Prepare the cash budget by month and in total for the first quarter of 2002. (15 marks)

(b) Identify and comment on those areas ofthe cash budget that you wish to draw to the attention ofthe Directors of T Ltd, and recommend action to improve cash flow. (7 marks)

(c) Briefly explain three advantages for T Ltd of using a spreadsheet when preparing a cash budget

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780273687511

3rd Edition

Authors: Charles T. Horngren, George Foster, Srikant M. Datar