The Kalman Co., a subsidiary of the Camper Corporation, submits interim financial statements. Camper combines these statements

Question:

The Kalman Co., a subsidiary of the Camper Corporation, submits interim financial statements. Camper combines these statements with similar statements from other subsidiaries to prepare its quarterly statements. The following data are taken from the records and accounts of the Kalman Co.

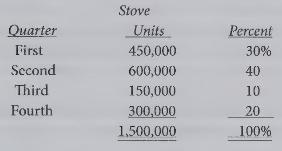

Sales forecasts for the year are:

Sales have been achieved as forecast in the first and second quarters of the current year.

- Management is considering increasing the selling price of a stove from \(\$ 30\) to \(\$ 34\). However, management is concerned that this increase may reduce the already low sales volume forecasts for the third and fourth quarters.

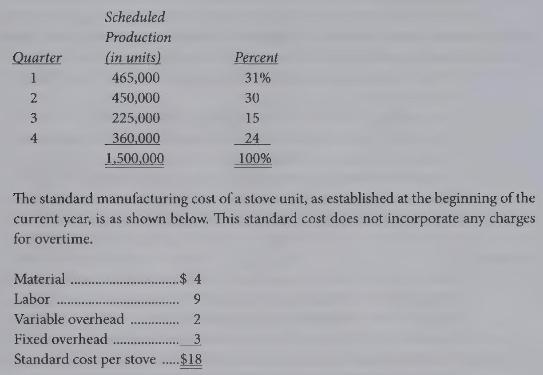

- The production schedule calls for \(1,500,000\) stoves this year. The manufacturing facilities can produce \(1,720,000\) units per year or 430,000 units per quarter during regular hours. The quarterly production schedule shown below was developed to meet the seasonal sales demand and is being followed as planned.

- A significant and permanent price increase in the cost of raw material resulted in a material price variance of \(\$ 270,000\) for the materials used in the second quarter.

- There was a \(\$ 120,000\) unfavorable direct labor variance in the second quarter due in part to overtime pay to meet the heavy production schedule. An overtime premium equal to .5 times the standard labor rate is paid whenever production requires working beyond regular hours. The remaining amount of the labor variance during the quarter occurred as a result of unexpected inefficiencies.

- The second quarter unfavorable variable overhead variance of \(\$ 36,000\) was entirely related to the excess direct labor costs.

- Total fixed overhead expected to be incurred and budgeted for the year is \(\$ 4,500,000\). Through the first two quarters, \(\$ 2,745,000\) of fixed overhead has been absorbed into the production process. Of this amount, \(\$ 1,350,000\) was absorbed in the second quarter. The high production activity resulted in a total fixed overhead volume variance of \(\$ 495,000\) for the first two quarters.

- Selling expenses are 10010 of sales and are expected to total \(\$ 4,500,000\) for the year.

- Administrative expenses are \(\$ 6,000,000\) annually and are incurred uniformly throughout the period.

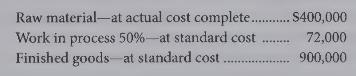

- Inventory balances as of the end of the second quarter are as follows:

The stove product line is expected to earn \(\$ 7,500,000\) before taxes this year. The estimated state and federal income tax expenses for the year are \(\$ 1,500,000\).

Any unplanned variances which are significant and permanent in nature are prorated to the applicable accounts during the quarter in which they are incurred.

{Required:}

Prepare the second quarter interim income statement for the Kalman subsidiary of Camper Corporation.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline