The S.T. Shire Company uses direct costing for internal management purposes and absorption costing for external reporting

Question:

The S.T. Shire Company uses direct costing for internal management purposes and absorption costing for external reporting purposes. Thus, at the end of each year financial information must be converted from direct costing to absorption costing in order to satisfy external requirements.

At the end of \(20 \mathrm{X} 0\), it was anticipated that sales would rise \(20 \%\) the next year. Therefore, production was increased from 20,000 units to 24,000 units to meet this expected demand. However, economic conditions kept the sales level at 20,000 units for both years.

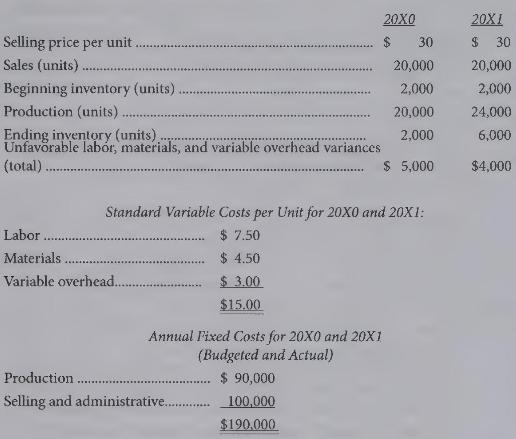

The following data pertain to \(20 \times 0\) and \(20 \mathrm{X} 1\).

The overhead rate under absorption costing is based upon practical plant capacity which is 30,000 units per year. All variances and under- or over absorbed overhead are taken to cost of goods sold. All taxes are to be ignored.

{Required:}

(a) Present the income statement based on direct costing for 20X1.

(b) Present the income statement based on absorption costing for 20X1.

(c) Explain the difference, if any, in the net income figures. Give the entry necessary to adjust the book figures to the financial statement figure, if one is necessary.

(d) The company finds it worthwhile to develop its internal financial data on a direct cost basis. What advantages and disadvantages are attributed to direct costing for internal purposes?

(e) There are many who believe that direct costing is appropriate for external reporting and there are many who oppose its use for external reporting. What arguments for and against the use of direct costing are advanced for its use in external reporting?

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline