The Texon Co. is organized into autonomous divisions along regional market lines. Each division manager is responsible

Question:

The Texon Co. is organized into autonomous divisions along regional market lines. Each division manager is responsible for sales, cost of operations, acquisition and financing of divisional assets and working capital management.

The vice president of general operations for the company will retire in September 2012. A review of the performance, attitudes, and skills of several management employees has been undertaken. Interviews with qualified outside candidates also have been held. The selection committee has narrowed the choice to the managers of Divisions A and \(\mathrm{F}\).

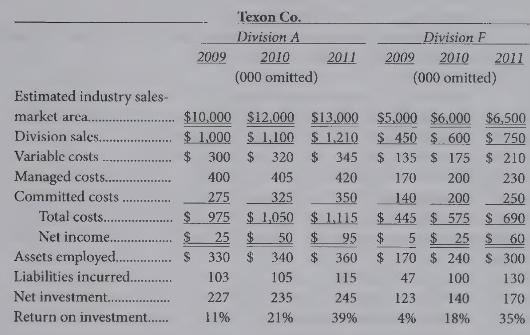

Both candidates were appointed division managers in late 2008. The manager of Division A had been the assistant manager of that division for the prior five years. The manager of Division F had served as assistant division manager of Division B before being appointed to his present post. He took over Division F, a division newly formed in 2007 when its first manager left to join a competitor. The financial results of their performance in the past three years is reported below:

{Required:}

(a) Texon Co. measures the performance of the divisions and the division managers on the basis of their return on investment (ROI). Is this an appropriate measurement for the division managers? Explain.

(b) Many believe that a single measure, such as ROI, is inadequate to fully evaluate performance. What additional measure(s) could be used for performance evaluation? Give reasons for each measure listed.

(c) On the basis of the information given, which manager would you recommend for vice president of general operations? Present reasons to support your answer.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline