You have just been appointed management accountant to a company that markets three products. These are sold

Question:

You have just been appointed management accountant to a company that markets three products. These are sold to a wide range of industries and marketing is done through three geographical areas: South, Midland and North.

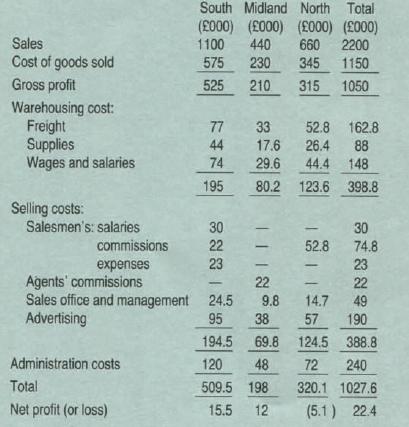

For the year ending 31 December 1981the company presents you with the budget as shown below:

Budget for year ending 31 December 1981

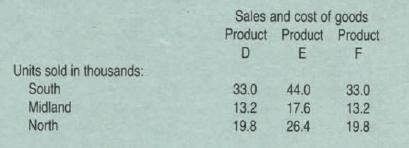

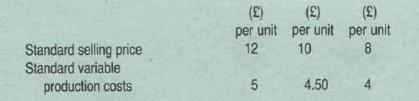

Your investigations into the budgeted figures reveal the following:

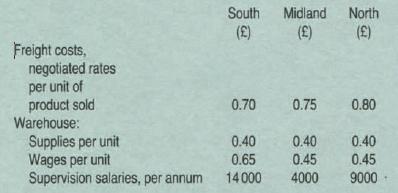

Fixed production overhead included 1n cost of goods sold is £160000 per annum. Warehousing costs (packaging and despatch are done 1n each area).

Selling costs.

In South area there are six salesmen each patc1 a basic wage of £5000 per annum with a commiss1on of 2% of sales. Their fixed expenses are £2000 per annum each and variable expenses are 1% of sales In Midland area, manufacturers ' agents are used. They rece1ve a commission of 5% of sales from which they have to meet all their expenses. However, they can also sell products of other manufacturers provided these are not directly competitive.

In North area there are three salesmen paid solely by a comm1ssion of 8% of sales. From this they have to meet all their expenses.

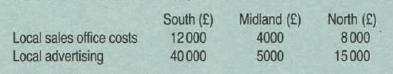

The salaries of the company sales manager and his assistant together with their expenses, total £25 000 per annum. Of the total advertising, £130000 is national advertismg under the direction of the company sales manager Other sales office and advertising costs

Administration costs, per annum.

FIXed costs relatmg to the whole company are £140 000.

The remainder varies with the number of orders which are budgeted at. South 32000; Midland 6000; North 12000.

The company uses a cut-off rate of 14% per annum in deciding on capital expenditure projects.

You are to deal with each of the following four requirements independently of one another. Assume that items not affected by the suggested changes stay the same ; ignore taxation and inflation.

(a) State with reasons whether, in view of the loss shown in the budget presented to you, you agree with a proposal to close the North area.

(b) Calculate what extra sales value would need to be made 1n the Midland area to cover additional local advertising of £15000 there and provide an extra profit of £10000.

Assume that the average value per order remains constant

(c) Calculate the benefit or otherwise of a proposal to change in Midland area from manufacturers' agents to a salaried sales force of three salesmen paid on the same basis as those in South area if an mcrease in sales of 15% were achieved (representing an 1ncrease of 10% of the number of orders)

as a result of the change

(d) Explain, with supporting calculations , whether you would approve of a proposal to change the basis of remuneration of salesmen in North area to that operating in South area.

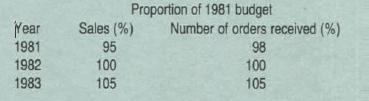

The change would require the immediate payment of £3500 to each salesman in North area as compensation , and. as a result of the change. sales would alter as follows

Step by Step Answer: